Our results

REFERENCE ACCOUNT 100,000 USDT

2025:

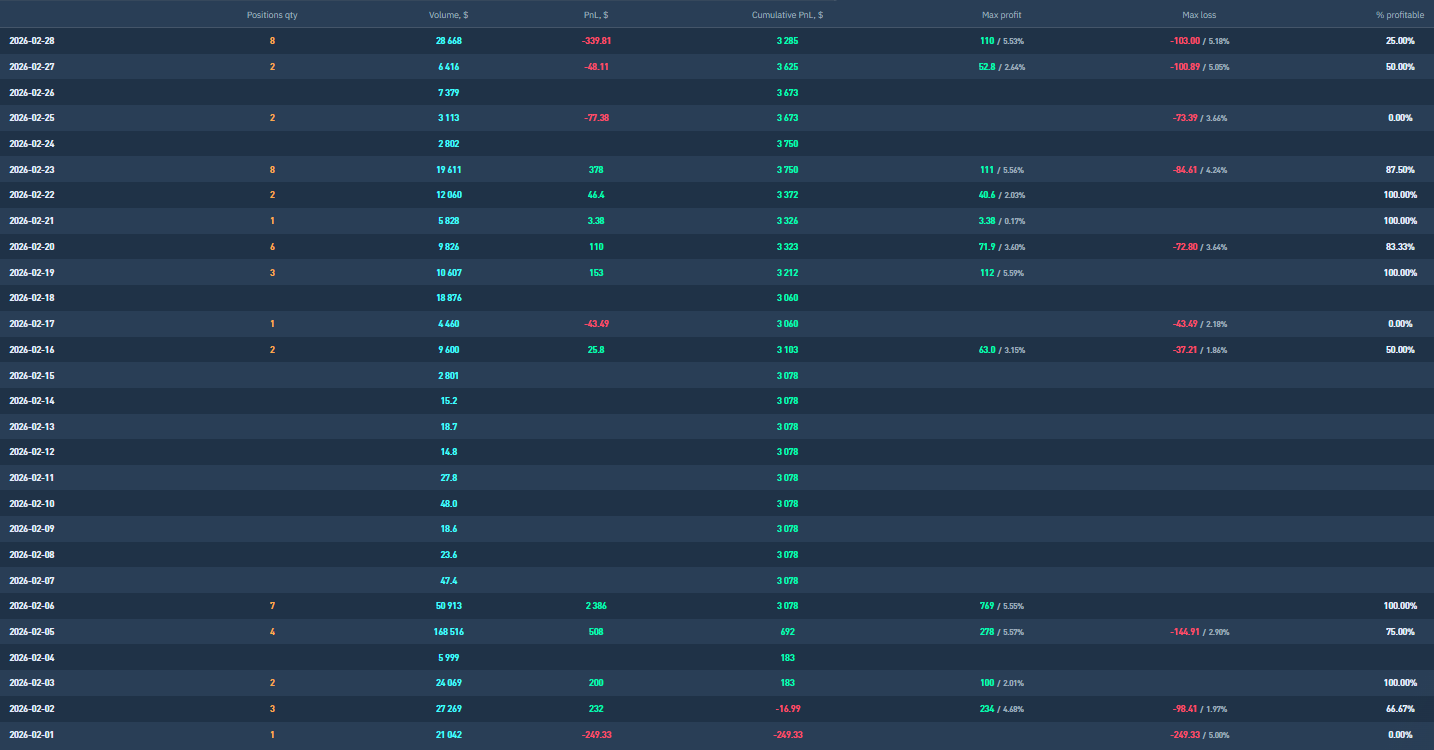

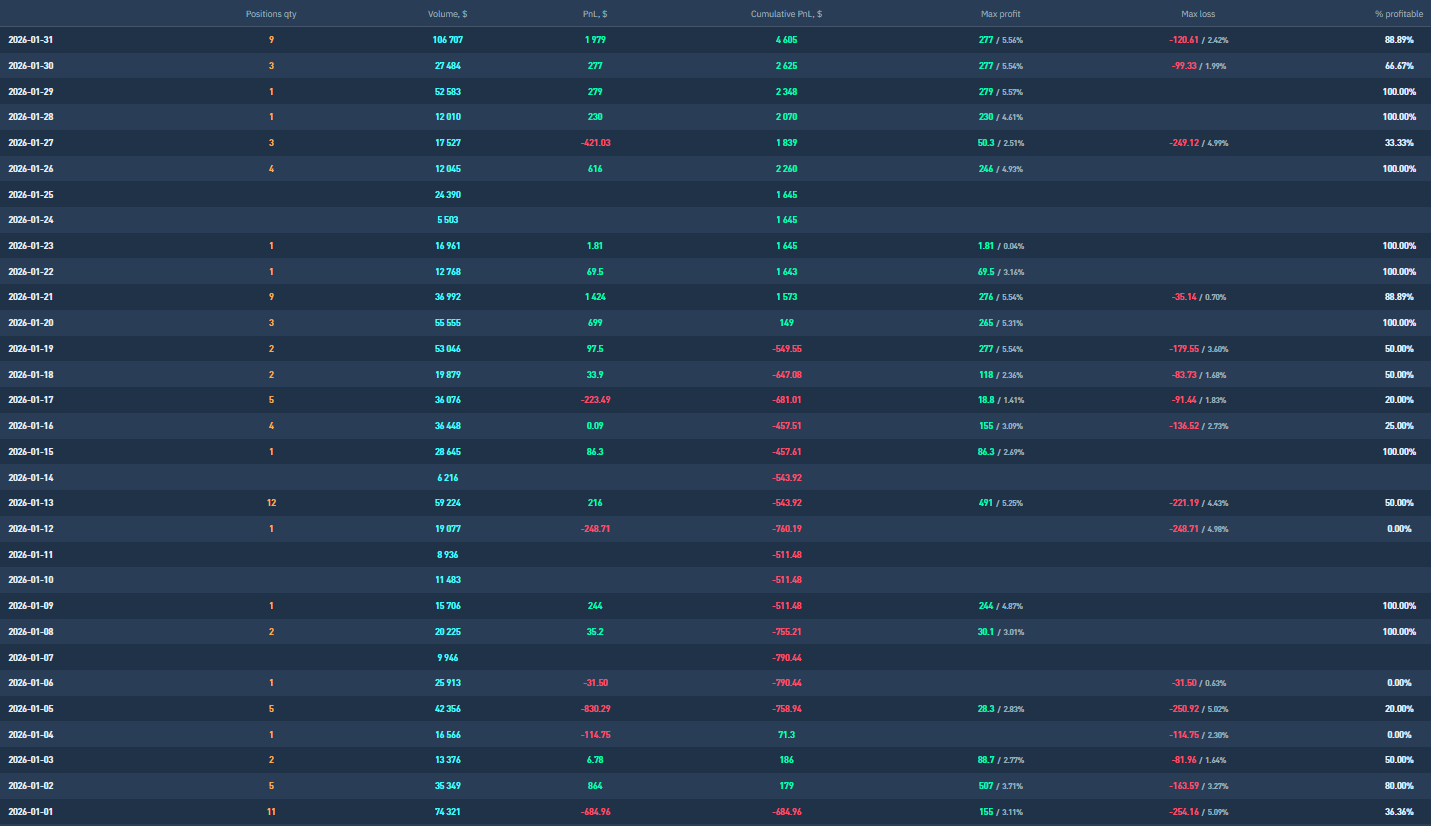

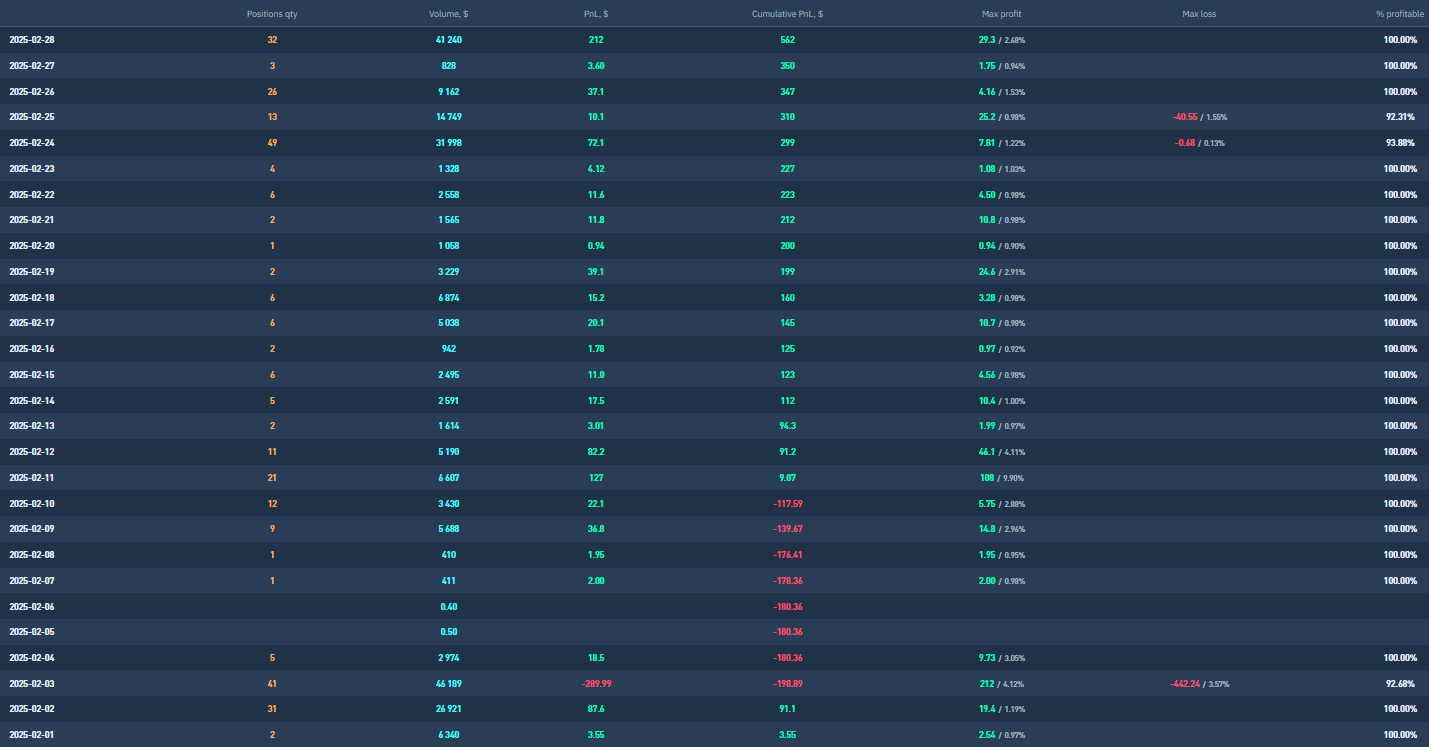

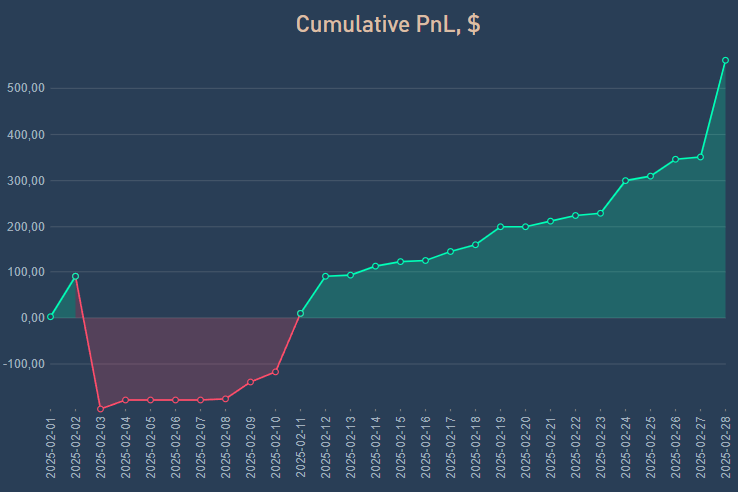

February 2026

+3,28%

Cryptocurrency Market in February 2026: Capitulation, Stock Market Correlation, and the Search for a Bottom

February 2026 in the cryptocurrency market was marked by extreme volatility, strong macroeconomic influence from the United States, and rising investor fear. The dominant asset, Bitcoin, experienced a sharp decline within days—from levels above $80,000 down to $60,000. The market entered what can fairly be described as one of the most intense phases of the current bear cycle.

Early Month: Drop Below $80,000

The first days of February brought a rapid shift in sentiment. On February 1, Bitcoin fell below the $80,000 level. Initially, it appeared to be a standard correction following previous growth. However, by February 4, the price briefly tested levels below $73,000.

A key driver was uncertainty in U.S. equity markets. Sell-offs hit the technology sector particularly hard, led by NVIDIA, Microsoft, and Amazon, whose shares lost around 3% in a single day. Alongside them, the S&P 500 index weakened as well, with Bitcoin showing a strong correlation to its movement.

The “digital gold” narrative once again came under pressure. It became clear that in a risk-off environment, Bitcoin remains closely tied to broader risk assets.

February 6: Testing $60,000 and Extreme Fear

A turning point came on February 6, when Bitcoin tested the $60,200 level during overnight trading. Since the beginning of the year, it had lost more than 25%, forming its third consecutive weekly red candle.

The market experienced:

- Massive liquidations of leveraged positions amounting to billions of dollars

- A sharp spike in volatility

- A collapse in investor sentiment

The Fear and Greed Index dropped to just 9 out of 100. By February 25, it had fallen further to 5—one of the lowest readings since 2018.

Technical indicators such as RSI entered deeply oversold territory (at one point reaching 16), which historically has often signaled the potential for a short-term rebound.

U.S. Shutdown, Macro Data, and Equity Market Dominance

Throughout the month, price action was heavily influenced by U.S. macroeconomic data, including:

- Purchasing Managers’ Index (PMI)

- Retail sales

- Unemployment rate

- Inflation

- Labor market and housing data

For example, unexpectedly low inflation (2.4% year-over-year—the lowest since May of the previous year) briefly supported both equities and Bitcoin. Conversely, weak labor market data and concerns about AI infrastructure spending triggered further sell-offs.

Bitcoin effectively mirrored the performance of the S&P 500 during February. The idea that Bitcoin operates independently of traditional markets was once again challenged.

Consolidation Between $65,000 and $70,000

From mid-February onward, the market stabilized within the $65,000–$70,000 range. This phase was characterized by:

- Declining trading volumes (a thin market)

- Bullish divergences forming on RSI

- A gradual increase in futures open interest

- Funding rates returning to positive territory

Derivatives data suggested that speculators were reopening long positions, particularly around the $66,000 level. At the same time, periodic long liquidations prevented a sustained upward breakout.

On-Chain Signals: Is a Macro Bottom Near?

On February 23, on-chain data delivered one of the most significant signals of the month. The Short-Term Holder Bollinger Bands indicator dropped to levels last seen during the 2018 capitulation.

Bitcoin was trading far below the average acquisition price of short-term holders. Historically, similar extremes have appeared near macro market bottoms.

Additional metrics showed:

- Long-Term Holder SOPR below 1 (indicating some long-term holders were realizing losses)

- Pressure concentrated primarily on “fresh capital”

- Relative calm among long-term investors

Analysts noted that in previous cycles, the true bottom often formed only after full capitulation among long-term holders. This suggests the market may still require a final “shakeout.”

Possible Scenarios Ahead

By the end of February, the market faced three primary scenarios:

1️⃣ Breakout Above $71,500

Confirmation of a reversal and potential move toward higher levels.

2️⃣ Another Retest of $60,000

A textbook support retest before a stronger rebound.

3️⃣ Deeper Flush Toward $50,000 or Lower

Psychological capitulation typical of late-stage bear markets. Some more conservative projections even mentioned the possibility of a drop toward $35,000 as an “ideal” cyclical bottom.

Conclusion: February as a Stress Test for the Market

February 2026 can be summarized as a month of:

- Extreme volatility

- Strong correlation with U.S. equities

- Massive liquidations and capitulation-level sentiment

- Emerging long-term bottoming signals

Bitcoin hovered between continued downside risk and the formation of conditions for a new cycle. History shows that periods of maximum pessimism often create the most attractive long-term opportunities—yet past cycles do not guarantee future outcomes.

As the market enters March, tension remains between support at $60,000 and resistance above $71,000. The next major move will likely be determined by macroeconomic data, liquidity conditions, and investor psychology.

One thing is certain: February 2026 reaffirmed that the cryptocurrency market remains a dynamic and highly sensitive ecosystem where technical analysis, macroeconomics, and human emotion intersect more than ever before.

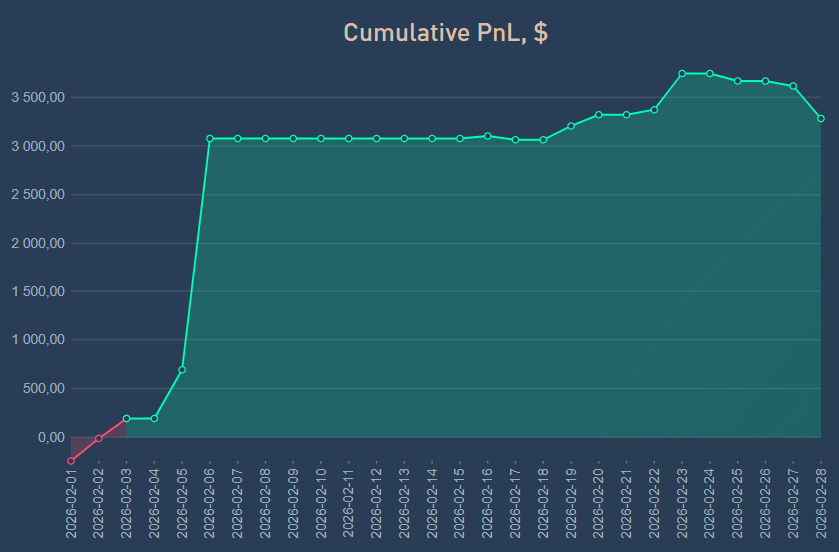

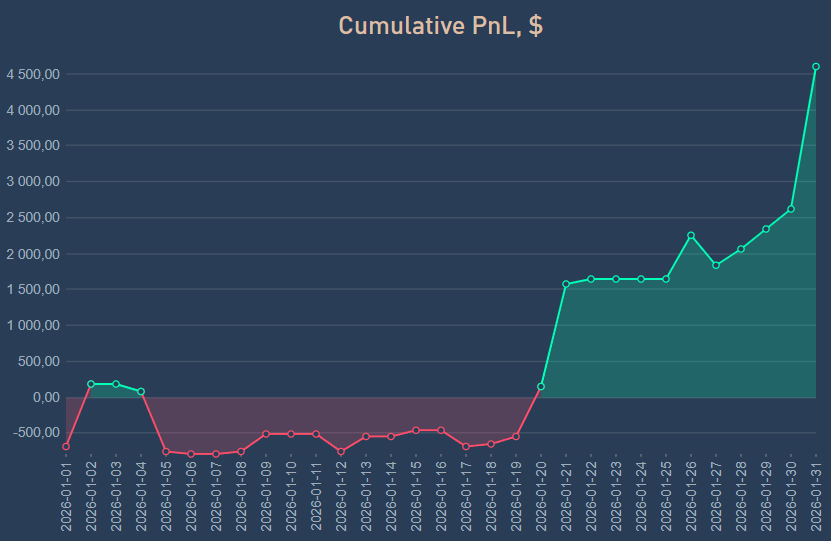

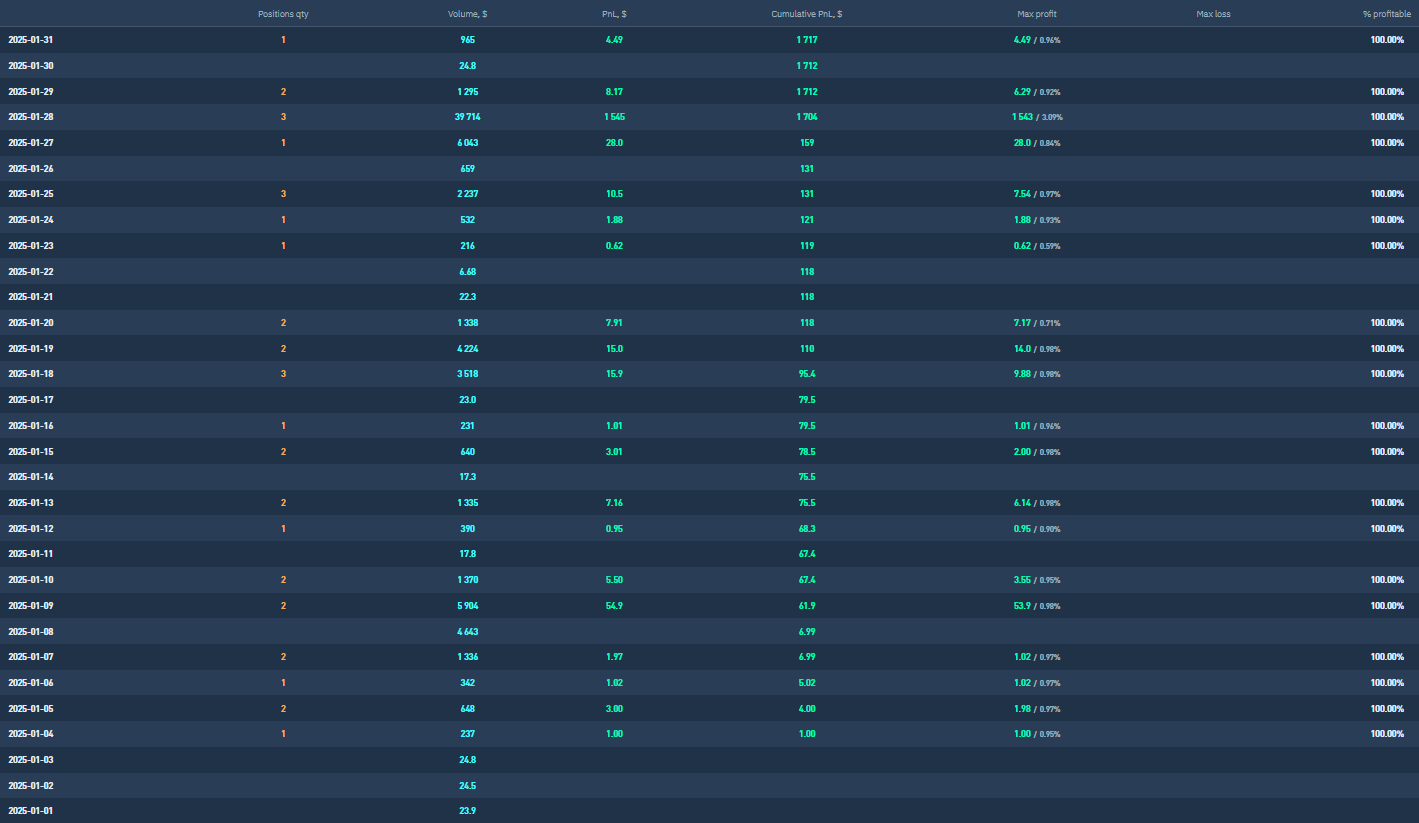

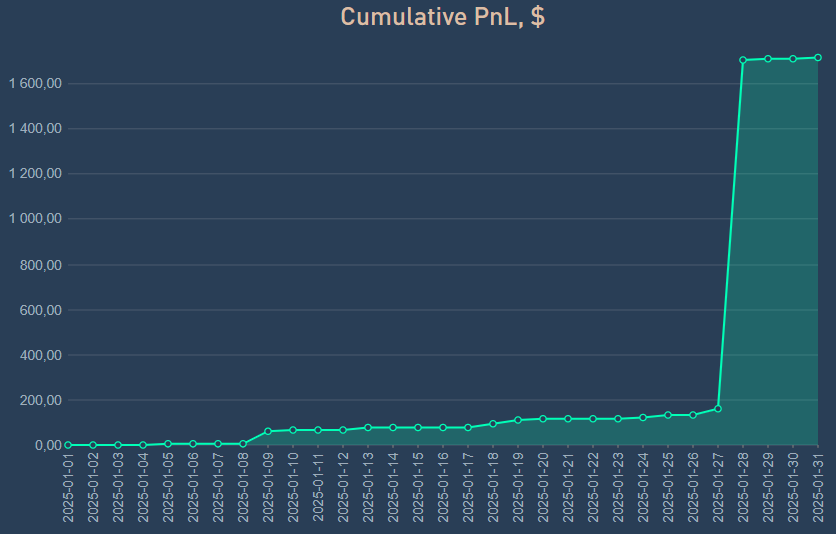

January 2026

+4,6%

The Cryptocurrency Market in January 2026: Between a Bear Market, Geopolitics, and Political Impulses

January 2026 on the cryptocurrency markets was marked by extreme volatility, conflicting signals, and a strong influence of geopolitical and political events. Throughout the month, Bitcoin traded within a wide range of approximately USD 87,000 to USD 98,000, repeatedly failing to break through the key resistance zone around USD 95,000–100,000. Investors were thus confronted with a fundamental question: is this merely a deeper correction within a long-term uptrend, or are we already in a full-fledged bear market?

The Beginning of the Year: Euphoria Versus Reality

As early as January 2, 2026, a debate emerged regarding the true nature of the current market trend. The chief analyst at CryptoQuant clearly labeled the situation as a bear market and warned that a potential price bottom could form as low as around USD 56,000. This view stood in sharp contrast to Bitcoin’s price action just two days later.

On January 4, Bitcoin entered the new year in a euphoric mood. The so-called “Santa Claus rally” continued beyond the year-end, and weekend trading brought further gains. Investor sentiment improved, as confirmed by the Fear and Greed Index, which moved into neutral territory for the first time since the dramatic sell-off in October 2025. Nevertheless, technical analysis was already highlighting the presence of multiple bearish signals on the charts.

Geopolitics as the Main Driver of Volatility

Geopolitical tensions became the dominant theme of the first half of January, particularly developments surrounding Venezuela. On January 5, Bitcoin was trading near its local highs around USD 92,000, while the market awaited reactions from traditional financial markets and Wall Street. U.S. military actions toward Venezuela increased volatility and helped Bitcoin gain approximately 2% over the weekend.

In the days that followed, however, it became clear that the rally was fragile. On January 7, Bitcoin was rejected near USD 95,000 and formed an Evening Star pattern, which often signals a potential trend reversal. A sequence of five consecutive green daily candles ended with a pullback toward the USD 92,000 level.

The Battle for the USD 100,000 Level

Mid-month, the market repeatedly attempted to reclaim the psychologically significant USD 100,000 level. On January 11, Bitcoin moved sideways, testing both support and resistance, as investors waited for a new catalyst—particularly from U.S. politics.

On January 14, Bitcoin once again approached what analysts half-jokingly referred to as the “death zone,” an area where sharp downward reversals had occurred repeatedly in previous weeks. Signals increasingly suggested that before any new bull market could emerge, the market might face another substantial downward move.

The Year of Donald Trump and Political Risk

One of the dominant factors of January 2026 was Donald Trump. His statements, decisions, and social media posts began to significantly influence not only cryptocurrencies but also equity, commodity, and bond markets. For intraday traders, Trump’s comments effectively became a key “indicator.”

Tensions escalated on January 18, when Trump’s tariff policies and the intensifying situation around Greenland triggered another wave of uncertainty. Although favorable U.S. inflation data (with month-on-month inflation stagnating at 2.7%) temporarily supported Bitcoin’s rise toward USD 94,000, technical indicators—especially the RSI—signaled an overbought market and bearish divergences.

Technical Signals and Growing Risks

The second half of the month brought a deterioration in the market’s technical outlook. A bearish flag formation appeared, a Death Cross formed on weekly moving averages, and a series of sell signals emerged—signals that in previous cycles often preceded deeper sell-offs. Bitcoin gradually retreated from the USD 91,000–97,000 range, and discussions increasingly turned toward a potential return to the November 2025 lows around USD 80,600.

On January 21, another significant decline occurred, with Bitcoin falling alongside equity indices as volatility surged. A combination of geopolitical risks, concerns about the independence of the Federal Reserve, and aggressive U.S. trade policies created an environment in which investors increasingly shifted into defensive positions.

End of the Month: Exhaustion and a Search for Direction

The final week of January was characterized by chaotic price action. Trump first announced tariffs on selected European countries, then subsequently revoked them, leading to sharp but short-lived price movements. Bitcoin dropped to around USD 87,000, where the CME gap from January 1, 2026, was filled.

Technical analysis on the daily and weekly charts suggested the possibility of a short-term rebound, but without clear confirmation of a trend reversal. The RSI hovered around neutral levels, and the market remained indecisive. One noteworthy signal was the behavior of so-called “whales,” which, according to available data, began accumulating again around the USD 90,000 level—suggesting that some institutional investors considered these prices attractive.

Conclusion

January 2026 demonstrated just how fragile and complex the current cryptocurrency market is. Bitcoin faced pressure from technical sell signals, geopolitical conflicts, and political interventions—particularly from the U.S. administration. While short-term bullish corrections cannot be ruled out, the overall market picture remains uncertain, with risks spread across multiple fronts simultaneously.

For investors, the message is clear: heightened caution, realistic expectations, and rigorous risk management are essential. The future remains shrouded in fog—and it is precisely in such an environment that true market preparedness is put to the test.

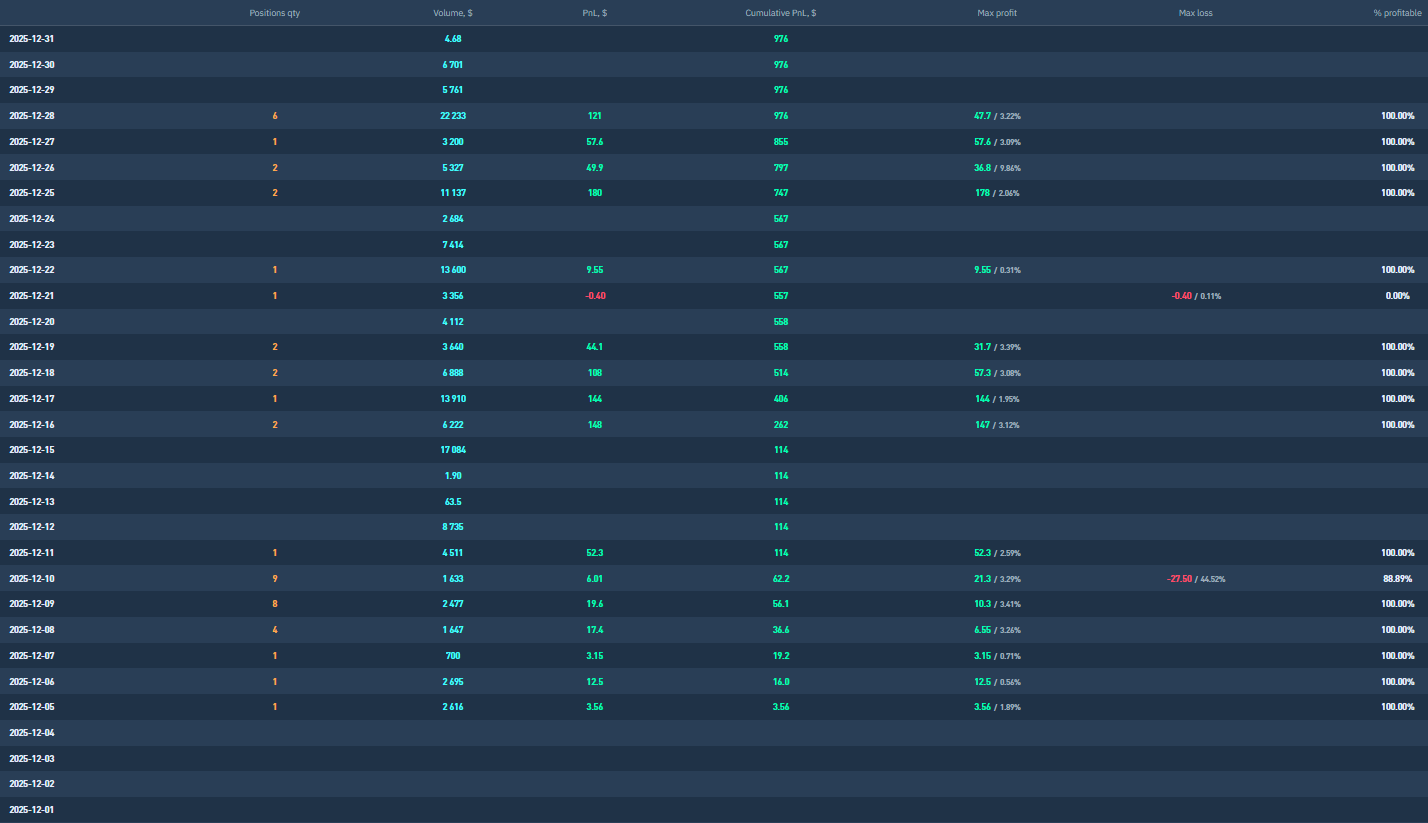

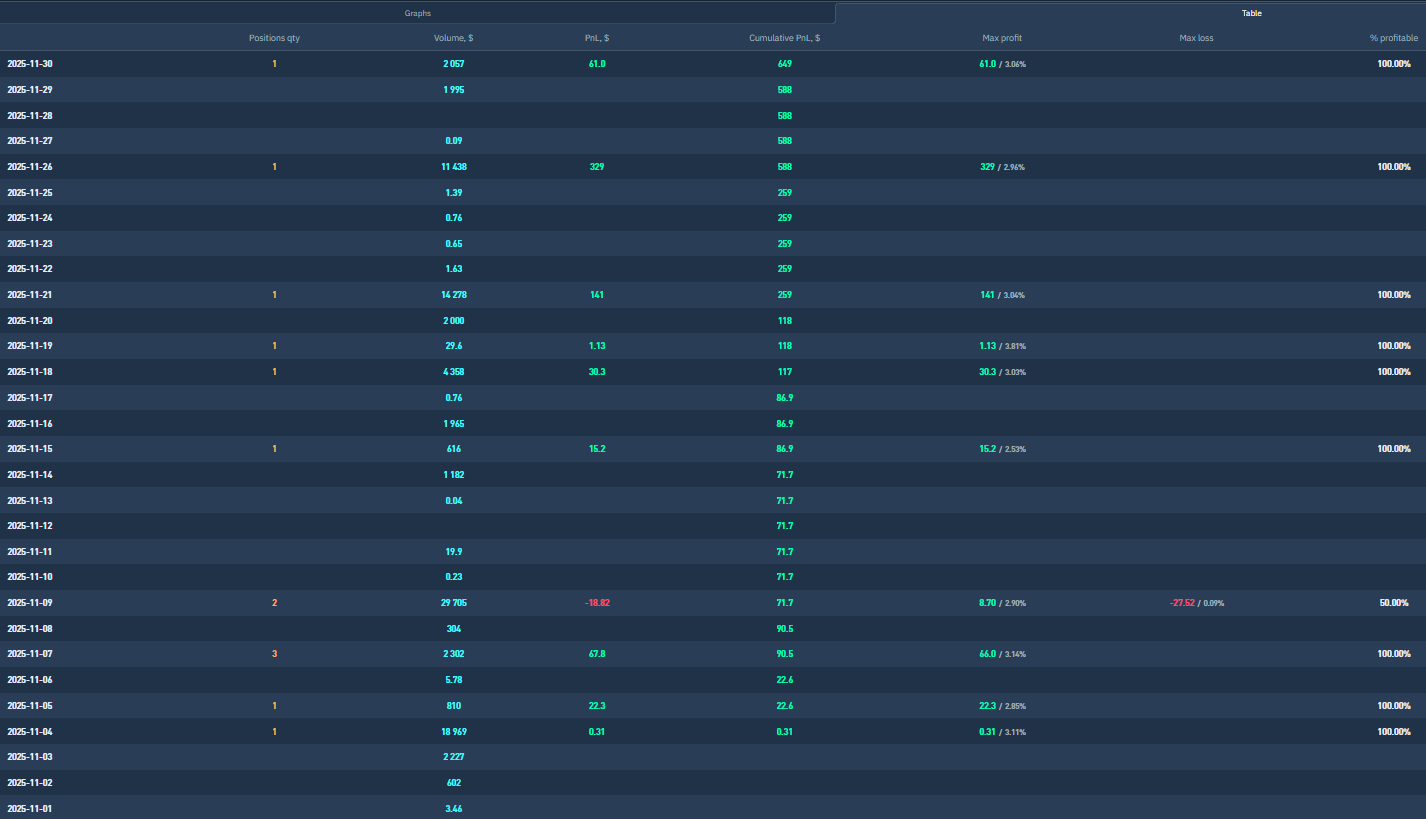

December 2025

+0,97%

The Cryptocurrency Market in December 2025: A Volatile Month Between Hopes for a New All-Time High and Fears of a Deeper Correction

December 2025 on the cryptocurrency market was marked by extraordinary volatility, uncertainty, and a sharp clash between bullish and bearish scenarios. Bitcoin, which had challenged historical highs above the USD 120,000 level in the autumn, entered the final month of the year weakened, with investor confidence significantly shaken. For most of December, the market stood at a crossroads between expectations of a return to growth and fears of a continuing correction.

Beginning of the Month: Sell-Offs, ETF Pressure, and the Search for a Bottom

The very first days of December brought a continuation of the November sell-off. Bitcoin fell below USD 86,000 and briefly tested the area around USD 80,000, which analysts identified as a key local bottom. A major negative factor was the massive outflow of capital from spot Bitcoin ETFs, which undermined the belief that institutional participation would automatically eliminate sharp price declines.

On December 2, the market lost approximately USD 150 billion in market capitalization within 24 hours, with Bitcoin falling to USD 84,000 and Ethereum to around USD 2,700. Speculation emerged that investors were reassessing their expectations regarding Federal Reserve rate cuts and a return of liquidity.

The situation was further worsened by selling from so-called whales. Data from CryptoQuant showed that large holders were sending up to 9,000 BTC per day to exchanges, representing roughly 45% of all inflows. As a result, Bitcoin’s price briefly dropped to around USD 80,600—its lowest level in the past seven months.

Regulatory and Institutional Impulses: Light at the End of the Tunnel

Alongside negative price movements, December also brought several major fundamental developments. The United Kingdom passed the Property Act 2025, which officially recognized digital assets as a separate category of property. Cryptocurrencies, including stablecoins, thus gained a clear legal framework, a move considered one of the most significant steps in the history of British property law.

Positive signals also came from the institutional sphere. Bank of America openly recommended cryptocurrencies, and Charles Schwab announced that it would allow its clients to trade Bitcoin and Ethereum in 2026. Japan simultaneously signaled preparations to approve spot Bitcoin ETFs, with estimated potential inflows of USD 3–10 billion.

These developments translated into a short-term rally—at the beginning of the second week of December, Bitcoin returned above USD 93,000, and technical indicators began to suggest the formation of a local bottom.

Mid-Month: The Fed, Macroeconomics, and Loss of Momentum

A key moment of the month was the U.S. Federal Reserve meeting on December 11, when interest rates were cut by 0.25 percentage points. Although the move was widely expected, the accompanying communication was perceived by the market as hawkish. Bitcoin failed to break through resistance at USD 94,000 and remained trapped in a broad range between USD 85,000 and USD 93,000.

Technical analysis gradually began to send warning signals. A bearish flag pattern formed on the charts, and some analysts openly discussed the possibility of a drop to as low as USD 67,000. Uncertainty was further amplified by fears of an interest rate hike by the Bank of Japan, which historically has led to 20–30% corrections in Bitcoin.

Altcoins showed mixed performance. While XRP recorded extremely high funding rates and strong speculative interest in derivatives, Ethereum gradually stabilized and returned above USD 3,000 toward the end of the month, supported by improved on-chain data.

End of the Year: Consolidation, Low Liquidity, and Waiting

The final weeks of December were characterized by low volatility and a narrow trading range. Bitcoin spent most of the time between USD 86,000 and USD 90,000, while network activity and the number of active addresses fell to their lowest levels of the past year.

Spot ETFs recorded outflows exceeding USD 1.1 billion toward the end of the year, the largest since autumn. Analysts noted, however, that this was more likely a seasonal effect and portfolio rebalancing rather than a structural exit by institutions. On the contrary, December 19 saw one of the strongest single-day ETF inflows of USD 457 million, highlighting continued institutional interest.

Technical indicators, such as bullish RSI divergence on higher time frames, suggested that the market was sitting on an important support level and preparing for a larger move. The direction of this move, however, remained unclear by year-end.

Conclusion: December as a Month of Indecision

December 2025 revealed the cryptocurrency market in all its complexity. On one side were strong fundamentals—institutional adoption, regulatory progress, and a long-term positive macroeconomic outlook. On the other side persisted pressure from ETF outflows, uncertainty surrounding monetary policy, and technical signals warning of further correction.

Bitcoin ultimately ended the year in negative territory, without reaching the psychological USD 100,000 level. At the same time, it remained well above key long-term support levels, suggesting that December was not the end of the bullish cycle, but rather a period of consolidation and regrouping ahead of the next major move in 2026.

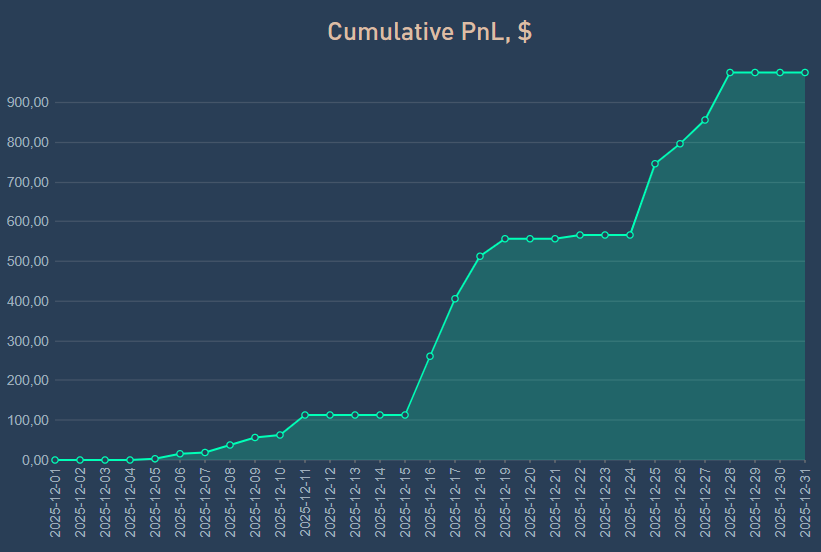

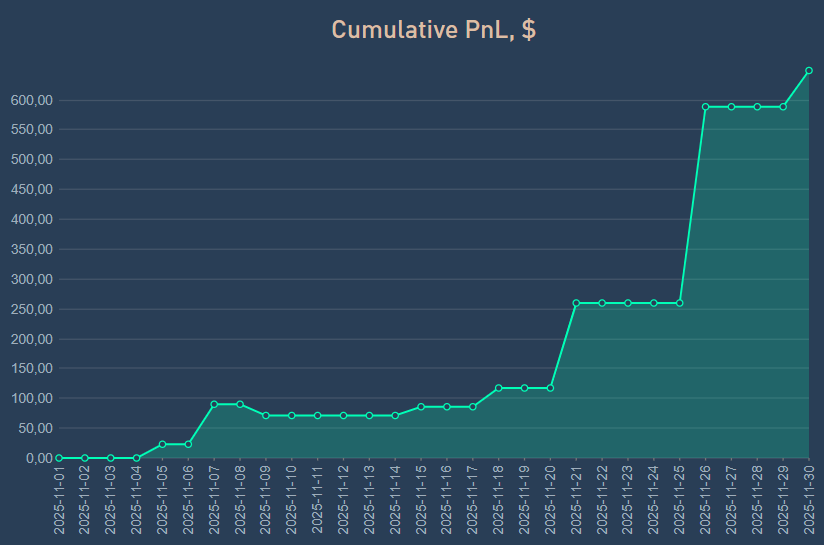

November 2025

+0,64%

CRYPTO MARKET REVIEW – NOVEMBER 2025

1. Introduction: November 2025 – a month of transition from euphoria to panic

The cryptocurrency market went through one of the most turbulent periods of the past two years. Bitcoin, which was still trying to maintain bullish sentiment in October, entered a deep decline in November — accompanied by panic, massive liquidations, record volatility, and the worst market sentiment since spring 2024.

The drop in BTC from October’s USD 126,000 to around USD 80,000 within roughly four weeks marked a technical entry into a bear market, while accompanying macroeconomic factors were unusually contradictory. Despite rate cuts in the U.S. and a trade deal with China, the market reacted strongly negatively — a sign of exhausted bulls and structural weakness.

2. Macroeconomic background: Trump’s tariffs, the China deal, the shutdown, and lack of data

November was characterized by strong information asymmetry:

- The U.S. government shutdown limited the release of key economic statistics,

- the market relied mainly on media statements from the administration,

- ongoing uncertainty about U.S. tariff policy affected not only equities but also cryptocurrencies.

The new trade agreement between Trump and China delivered short-term bullish impulses, but the market immediately ignored them. Investor caution outweighed positive news — typical for the late-bull-market to bear-trend transition period.

3. Bitcoin price development: from USD 111,000 to USD 80,000

Key developments:

- Early November: BTC drops below USD 110,000, following the worst October since 2018.

- Nov 4–7: Fall below USD 104,000, then sharp liquidations below USD 100,000.

Massive derivatives liquidations:

- total USD 1.36 billion,

- USD 377 million in BTC,

- USD 316 million in ETH.

Nov 14–17: Another collapse below USD 95,000, then to USD 94,000 and further below USD 90,000.

Nov 19–22: Institutional support weakens; BTC enters the “maximum pain zone” around USD 82,000.

Nov 24: Sharp rebound — the entire crypto market gains USD 100 billion in market cap in a single day.

End of November: BTC trades between USD 86–92k, still below key levels.

Key technical findings:

- confirmed Death Cross → start of a bearish cycle,

- repeated rejection at USD 106,000 as strong resistance,

- on-chain indicators (aNUPL, STH activity) confirm sentiment weakening,

- declining open interest suggests incoming consolidation or a bottom.

4. Investor sentiment: fear dominates the entire month

The Crypto Fear & Greed Index fell:

- from above 40 to 21 (extreme fear),

- to levels not seen since April 2024.

The sentiment remained negative despite:

- interest rate cuts,

- the U.S.–China trade agreement,

- the end of the U.S. government shutdown.

The market confirmed a disconnect between macro news and price action — typically a sign of a deeper trend reversal.

5. Institutional flows: massive capital outflow

Crypto funds and ETP products saw:

- USD 2 billion outflow in a single week,

- USD 3.2 billion cumulative outflow over three weeks.

AUM fell:

- from October’s USD 264 billion,

- to USD 191 billion (–27%).

Institutions are taking profits, pulling capital, and reducing exposure — a typical sign of the mid-bear-market phase.

6. Whale activity: alternating distribution and aggressive accumulation

First half of the month:

- OG whales took heavy profits,

- the market reacted with strong sell-offs.

Second half of the month:

- as BTC fell below USD 90,000, whales switched to aggressive accumulation,

- but the buying was insufficient to stabilize the price.

Analysts highlight the return of a key liquidity pattern that tends to appear near cyclical local bottoms.

7. Altcoins in November 2025: volatility and the return of the privacy narrative

7.1. Privacy coins – the only clear winners of the month

- Zcash +80%, 7-year high

- Dash +80%, 3-year high

Drivers of the rally:

- short covering,

- capital diversification away from Bitcoin,

- speculation on the upcoming Zcash halving,

- heightened interest in privacy amid market uncertainty.

7.2. Ethereum

- drop to USD 2,800,

- four-month low below USD 3,000,

- liquidation wave of USD 316 million,

- partial recovery later thanks to ETF inflows.

7.3. Solana, XRP, BNB

When the market rebounded on Nov 24:

- XRP +7.72%,

- Solana +4.4%,

- BNB +3.9%.

8. Key indicators and market structure

Weakening BTC network activity:

Decline in:

- transactions,

- new addresses,

- profitability of holders.

STH capitulation zone:

Short-term holders entered heavy losses — historically a reliable signal of an approaching market bottom.

Futures market:

- backwardation signaled upcoming stabilization,

- sharp drop in open interest → market cleansing phase.

9. Summary: What was November 2025 like?

Bearish points:

- BTC drop from 111k → 80k USD,

- deep decline in institutional demand,

- massive ETF and ETP outflows,

- extreme panic according to sentiment indices,

- technical Death Cross and loss of key supports.

Bullish points:

- aggressive whale accumulation on dips,

- sharp +100B USD rebound in a single day,

- weakening selling pressure at month’s end,

- emerging bottom signals in futures and on-chain metrics.

10. Outlook for December 2025

Short-term (1–3 weeks):

- continued volatility between USD 82–97k,

- possible retest of USD 80k as a final bottom,

- high probability of short squeezes.

Medium-term (1–3 months):

- accumulation phase after massive capitulation,

- gradual return of institutional capital after the shutdown ends,

- potential beginning of a new cycle already in Q1 2026 if AUM starts to rise.

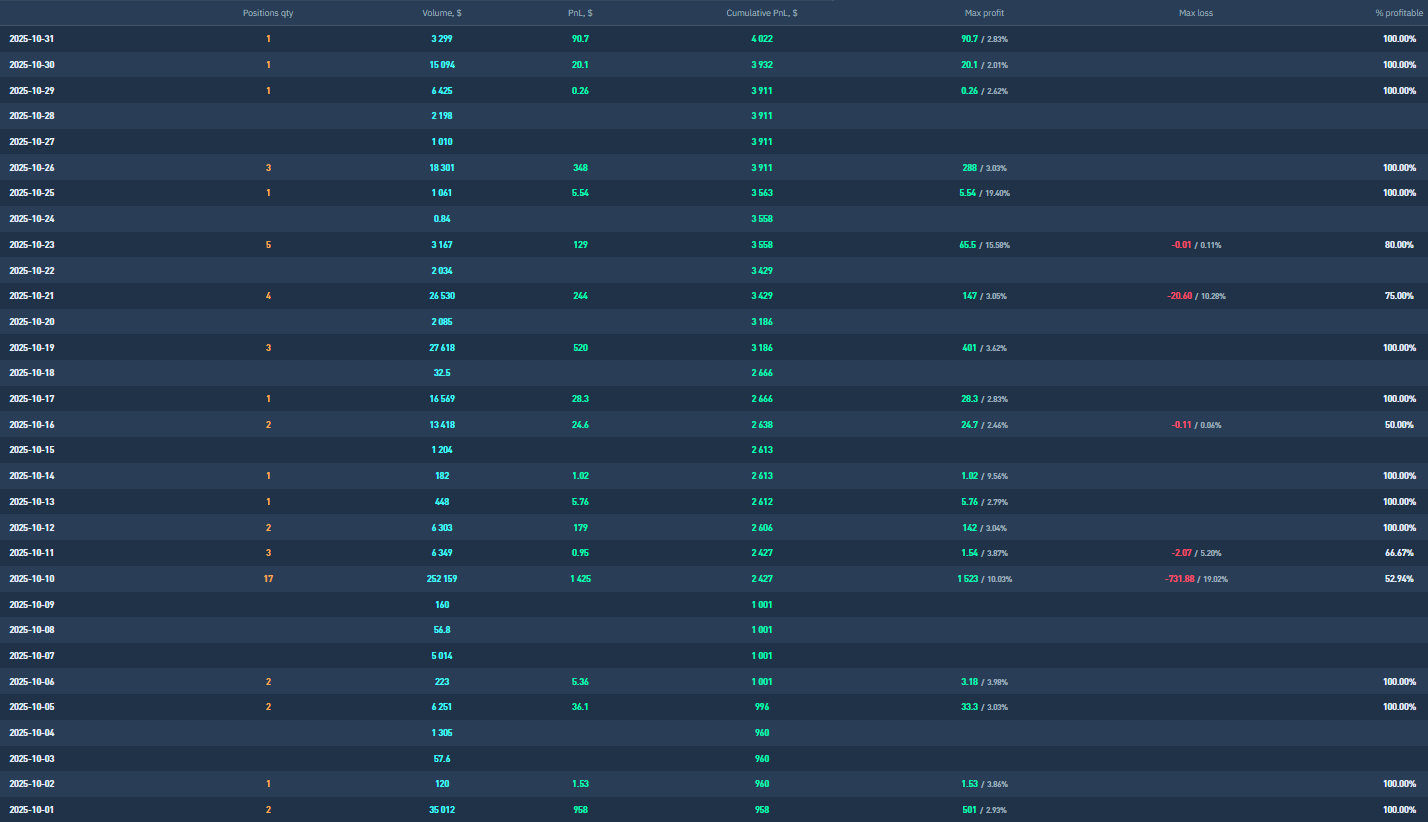

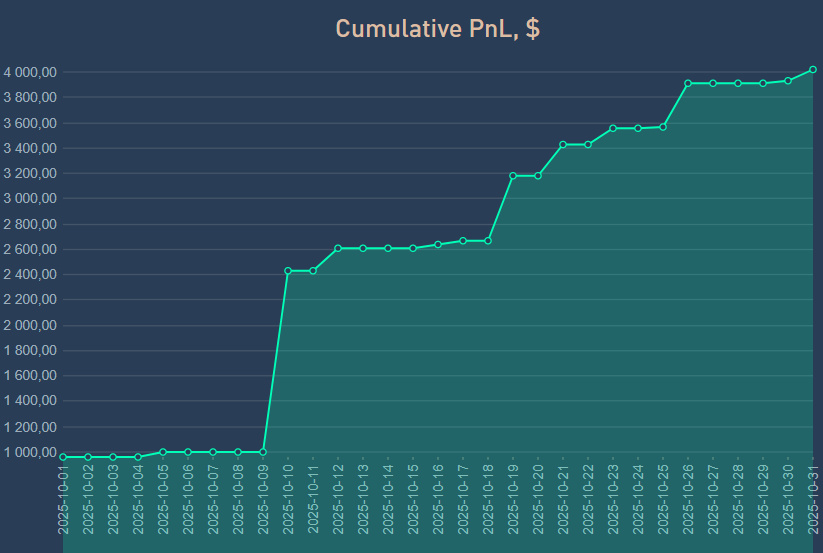

October 2025

+4%

Crypto Apocalypse of October 2025: The Biggest Market Crash in History

October 2025 will go down in crypto history as a month of absolute chaos. What began with euphoria and record highs turned within hours into the greatest trader wipeout in the history of digital assets. Never before had so many positions been liquidated — and never had the losses been so dramatic.

The Beginning: Bullish Frenzy and Historic Highs

The first days of October resembled crypto’s golden age. Bitcoin, which had hovered around $107,000 in September, skyrocketed on October 5th to $125,691, rewriting all previous records. Institutional investors led by BlackRock purchased over $3.8 billion worth of crypto, driving prices higher.

Ethereum broke through all major resistance levels, BNB climbed above $1,180, and XRP was heading toward $15. The total cryptocurrency market capitalization exceeded $4.2 trillion. Pure euphoria ruled the markets — and it seemed this time, the rally had no ceiling.

October 10, 2025: The Day the Crypto World Burned

Then came crypto’s Black Wednesday. President Donald Trump announced 100% tariffs on Chinese imports and export restrictions on critical software. Markets turned to panic within minutes.

Bitcoin dropped from $121,000 to $105,000 within hours — and that was only the beginning. Altcoins became a battlefield. Overnight, over $19 billion in leveraged positions were liquidated — nineteen times more than during the FTX collapse. It was the largest capital wipeout in crypto history, greater than LUNA’s crash or the 2020 COVID plunge.

Almost everyone trading leveraged altcoins on October 10th was wiped out. Chain liquidations triggered a domino effect, erasing entire accounts within minutes as hedge funds lost hundreds of millions. Many algorithmic strategies were devastated by unprecedented volatility unseen in any historical data.

“I’ve never seen anything like this,” one trader wrote on X.

“A single candle erased three years of profits — from 125k to zero in 30 seconds.”

Binance Under Pressure

During the crash, Binance faced a near-total technical collapse. Systems overloaded by millions of liquidations froze, charts stopped updating, and orders disappeared. Some tokens even lost their price feed temporarily, plunging close to zero.

“Due to heavy market activity, our systems are under high load,”

Binance reported on October 10th.

The exchange later announced $283 million in user compensation, admitting that part of the losses came from technical failures, not just market movement.

Impact and Lessons from the Altcoin Massacre

The October 10th massacre hit everyone — from retail traders to major hedge funds. Even sophisticated algorithms couldn’t withstand the lightning-fast volatility and cascading liquidations.

The day clearly demonstrated how dangerous the mix of high leverage, low liquidity, and overheated sentiment can be. Many altcoin-heavy portfolios were severely damaged, leading to a natural restructuring of risk exposure.

We, too, felt the impact — particularly in our altcoin-focused test portfolio. Yet the episode provided valuable insights into risk management, proving that sustainable growth is only possible through diversification and disciplined capital allocation.

Resilience of the Core Accounts

While the altcoin market suffered catastrophic losses, strategies focused on Bitcoin, Ethereum, and major currency pairs performed exceptionally well. After a brief dip, they quickly regained balance and ended the month in profit.

The results underscored a clear truth: stability and a conservative approach yield the best long-term results. Investment discipline, prudent leverage, and robust risk management once again proved to be the pillars of lasting success.

Second Half of the Month: From Ashes to Stabilization

After the explosion, the market gradually calmed. Bitcoin consolidated around $110,000, and institutions resumed accumulation. Political developments also eased tensions — on October 23rd, Donald Trump pardoned Binance founder Changpeng Zhao, and on October 29th, the Fed cut interest rates by 25 basis points, boosting market liquidity.

Out of the ashes, cautious optimism began to grow. Stablecoins and RWA (Real-World Asset) projects took the spotlight as investors sought safer havens, and the market began to stabilize once again.

Key Events of October 2025

- New Bitcoin All-Time High: $125,691 (Oct 5)

- Largest Liquidation in History: $19 billion (Oct 10–11)

- Altcoin Collapse: many tokens −80 % to −95 %

- Fed Rate Cut: −25 bps (Oct 29)

- Trump Pardons CZ: (Oct 23)

- Institutional BTC Purchases: +$3.8 billion (BlackRock)

- Crypto Market Cap Drop: from $4.24 T to $3.79 T

- Binance User Compensation: $283 million

Outlook for November

The market is consolidating around $110,000, but nervousness remains high. Geopolitical tension, leveraged derivatives, and trader emotions continue to fuel volatility.

If the Fed maintains its dovish stance, Bitcoin could become the engine of the next growth cycle.

However, October 2025 proved that a single political decision can reshape the entire financial world within hours.

Conclusion

October 2025 was the month when the crypto market faced its toughest trial in history.

Liquidations broke every record — greater than COVID, FTX, and LUNA combined. Many strategies ended with zero balance, yet others emerged stronger than ever.

Bitcoin once again proved itself as the digital safe haven, while strategies built on discipline, stability, and long-term vision withstood conditions that would have annihilated most markets.

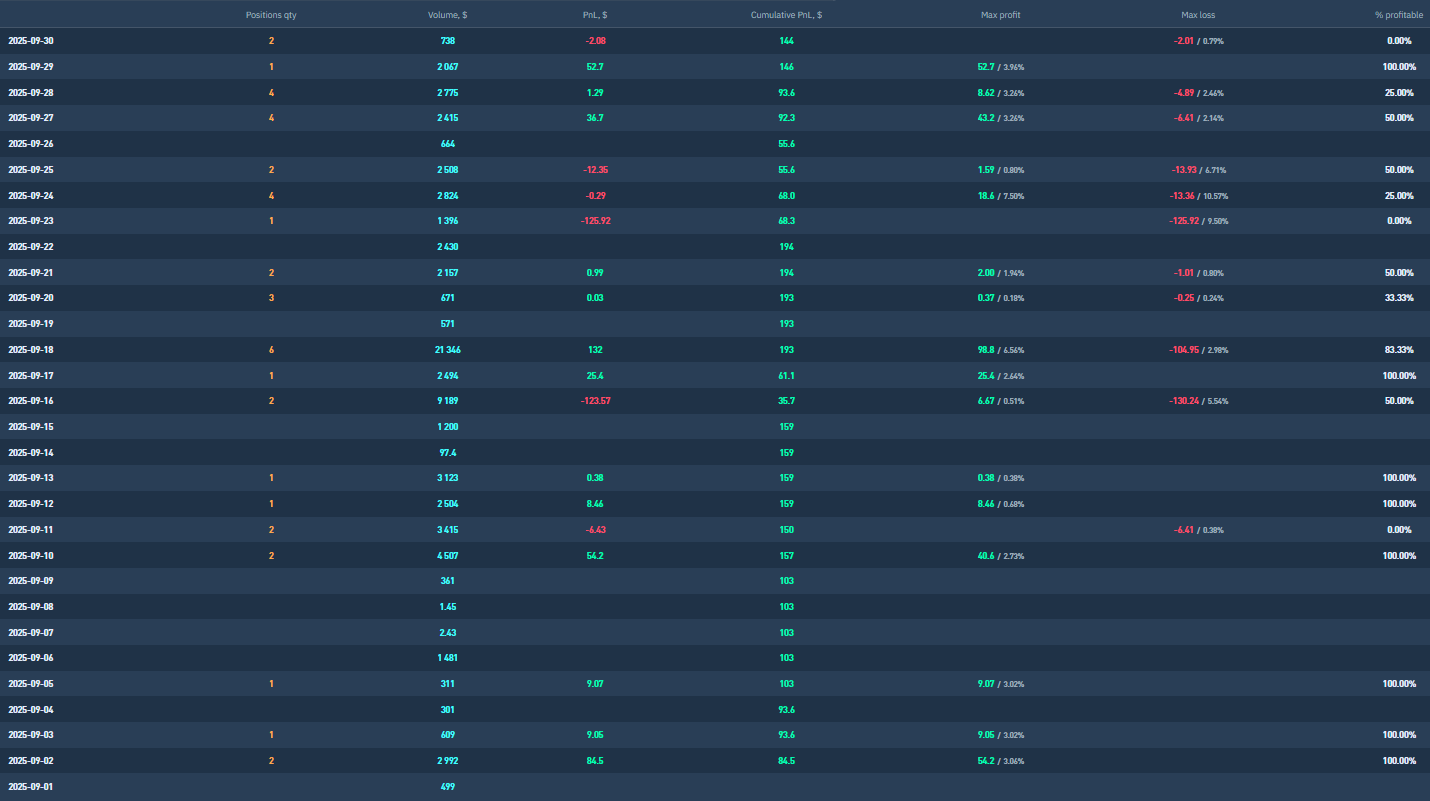

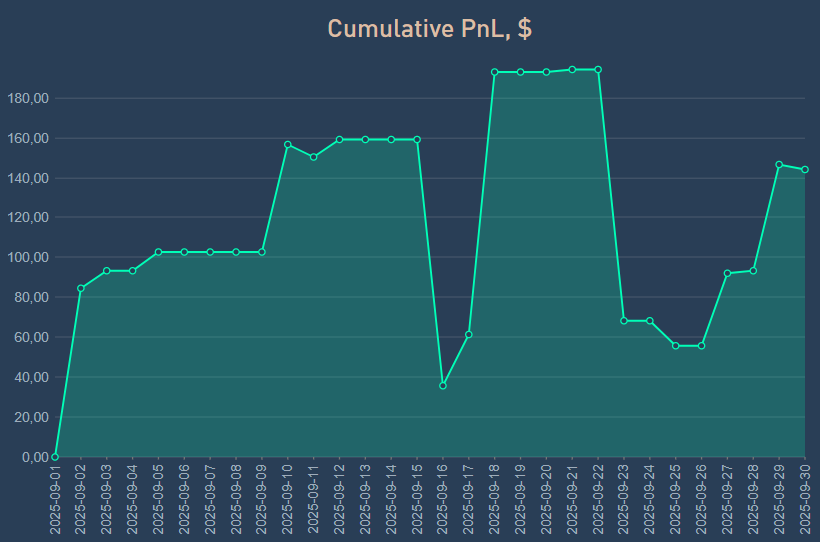

September 2025

+1,44%

Summary of the Cryptocurrency Market – September 2025

Institutional Activity and Funds

In September, strong interest from institutional investors in cryptocurrencies continued, with investments in Bitcoin ETFs reaching record levels. Funds holding BTC and ETH maintained a significant share of their portfolios, dominated by activity from major players, particularly BlackRock, which also shifted capital between different cryptocurrencies. New ETFs for XRP and Dogecoin appeared on the market, expanding institutional options and contributing to increased liquidity.

Bitcoin – Volatility and Key Levels

Bitcoin entered September after a decline below $110,000 in August, raising concerns about the continuation of the bearish trend. Throughout the month, the market mainly traded between $109,000 and $118,000, with several attempts to break above $120,000. The key psychological and technical level of $100,000 was closely monitored as an indicator of the bullish cycle’s stability.

Significant whale sell-offs occurred during the month, temporarily suppressing the price, while accumulation by other major players continued. Analysts noted a gradual return of optimism, supported by positive on-chain data and expectations of a continuing bullish cycle. Long-term projections suggested potential growth to $160,000–$185,000 by the end of the year.

Ethereum – Growth and Volatility

Ethereum continued its strong upward trend, gaining nearly 200% since spring and breaking a long-term downtrend. Short-term targets were identified between $5,000–$5,500, supported by limited supply and bullish sentiment. At the same time, Ethereum ETFs faced significant capital outflows, reflecting selective investor preferences and risk sentiment.

Altcoins – XRP, Solana, and Dogecoin

The altcoin market showed strong bullish signals. XRP went through a consolidation phase, testing levels between $3–$4.50, while Solana and Dogecoin experienced sharp gains due to increasing adoption and speculative activity. Overall, altcoins demonstrated potential for portfolio diversification and a possible “altcoin season.”

Macroeconomic Environment

The Federal Reserve’s 25 basis point rate cut triggered volatility in the crypto market and supported bullish sentiment, despite concerns about a potential recession in the U.S. and a slowing labor market. Gold reached record levels, sparking speculation about a possible correlation between BTC and gold. Overall, macroeconomic factors contributed to growing uncertainty while supporting interest in cryptocurrencies as alternative assets.

Overall Sentiment and Outlook

September 2025 confirmed that Bitcoin and major cryptocurrencies remain in a long-term bullish trend, despite short-term corrections and volatility. The market shows strong support from institutional investors, whales, and on-chain activity. Ethereum and selected altcoins demonstrated potential for continued growth. After this corrective period, another growth cycle is expected, with the possibility of new all-time highs for Bitcoin and significant appreciation of key altcoins.

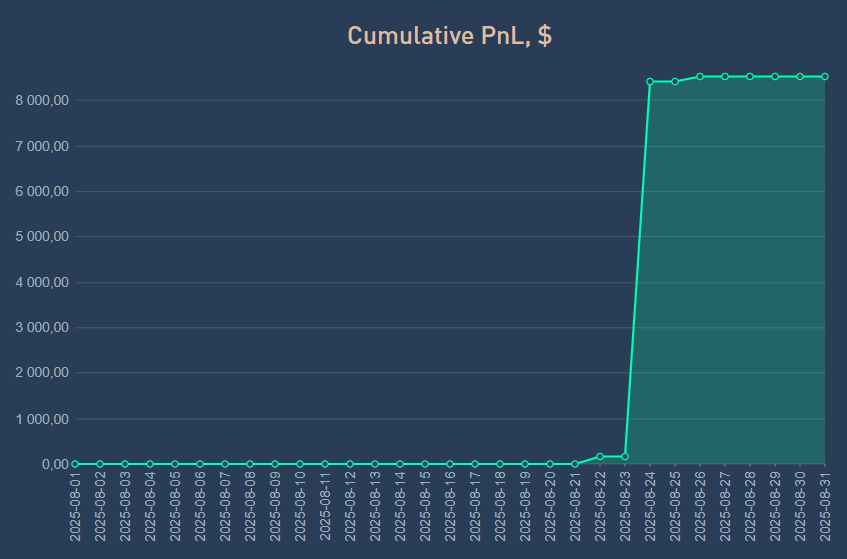

August 2025

+8,52%

Cryptocurrency Market Development – August 2025

August 2025 was a month of significant price fluctuations, technical formations, and geopolitical as well as macroeconomic influences for the cryptocurrency market. Bitcoin remained the main actor, accompanied by growing interest in Ethereum.

Bitcoin: Volatility and Technical Signals

Bitcoin entered August consolidating above USD 110,000, which it had maintained for 24 days (as of August 3). The market was influenced by geopolitical events and macroeconomic announcements – President Trump put pressure on the Fed and pharmaceutical companies, which, together with military maneuvers, caused short-term chaos. During this period, Bitcoin filled the CME gap from early July and initiated August’s upward movement.

The first weeks of August were marked by uncertainty surrounding the Fed’s monetary policy. Investors were awaiting clear signals from Jerome Powell on whether the planned rate cuts in 2025 would take place. Powell’s speech (August 5) delivered a rather cautious statement, leading to a slight decline in both the stock market and Bitcoin. Bearish signals emerged especially on August 6 and 8, when the price moved back toward USD 115,500.

In mid-August, Bitcoin broke above USD 122,000 (August 11), despite typically weaker weekend trading. Positive momentum was supported by large purchases from Strategy and Metaplanet funds. However, between August 13–15, a double-top formation emerged, signaling a potential bearish reversal. Meanwhile, Ethereum gained 33% thanks to a combination of geopolitical easing, the technological upgrade of the Pectra network, and a strong influx of capital into ETFs.

In the second half of August, Bitcoin continued to decline under pressure from rising inflation and the Fed’s failure to cut interest rates. The double top was confirmed on August 18, with the price falling by more than 7%, while the first significant support was located at USD 112,000. Further tests of this key level took place between August 20–25, with the market showing signs of weakness, although the support held.

Powell’s speech on August 24 brought a temporary rebound of Bitcoin above USD 117,000, but the market subsequently returned to testing the USD 110,000 level. At the end of the month (August 31), signs appeared that Bitcoin might return to USD 120,000 at the beginning of September, with trading relatively stable and analytically well-readable.

Ethereum: Growth and Investor Interest

Ethereum recorded strong growth thanks to a combination of market stabilization, technological improvements, and capital inflows into spot ETFs. The Pectra upgrade improved transaction speed and costs, increasing the attractiveness of the Ethereum ecosystem and supporting its growing mainstream appeal.

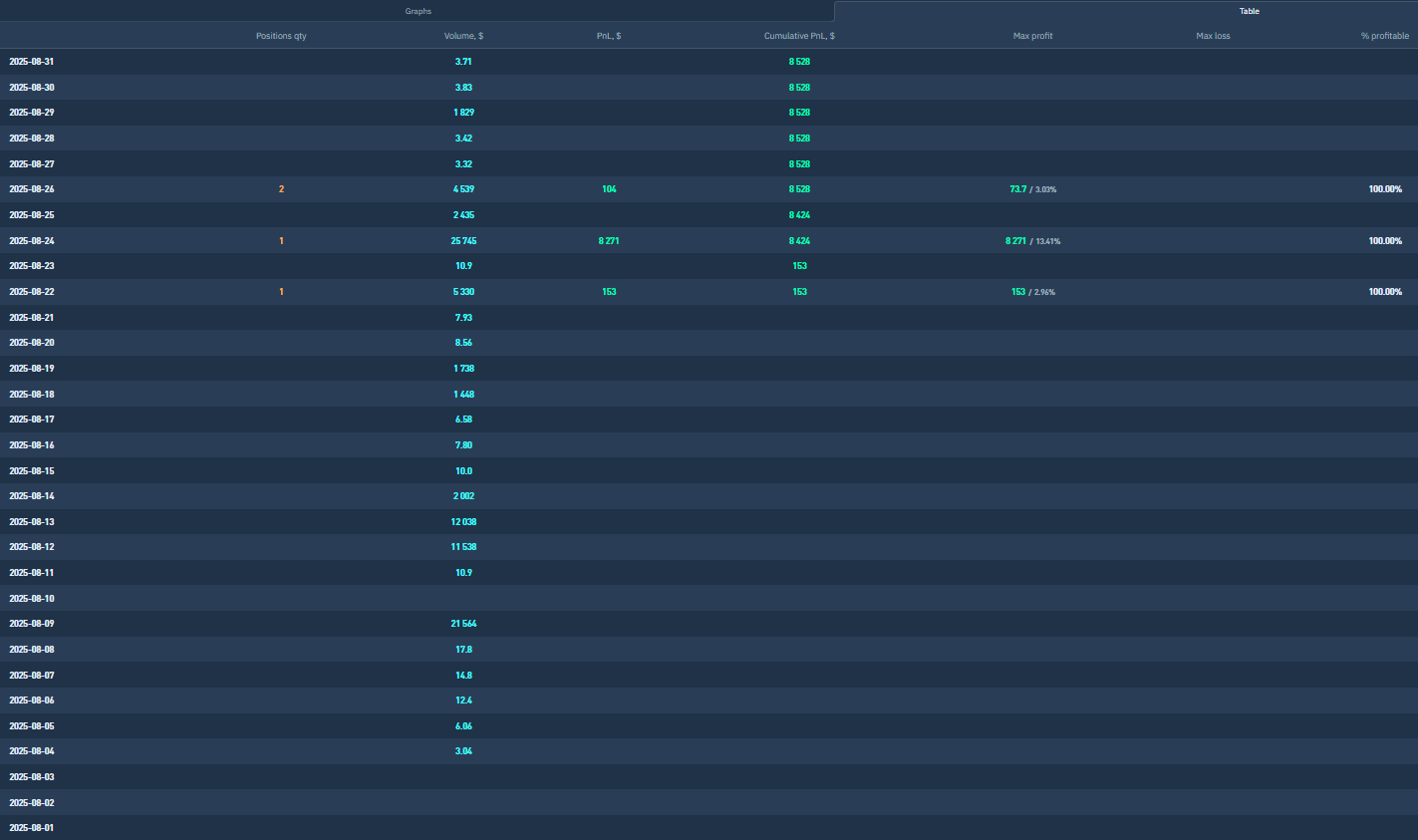

Algomoneo: Record-Breaking August 2025

For Algomoneo, August 2025 was the most successful month of the year so far. Sharp increases in the prices of major cryptocurrencies as well as numerous altcoins traded by the Algomoneo system, followed by subsequent declines, created a large number of opportunities, which the algorithm exploited with high efficiency to our satisfaction.

Summary

August 2025 showed that cryptocurrencies remain a highly volatile asset sensitive to macroeconomic data, geopolitics, and technical signals. While Bitcoin broke above USD 122,000, the double-top formation and repeated tests of support around USD 112,000 demonstrated the strength of bearish pressure. Ethereum leveraged rising optimism and technological improvements to achieve strong growth, supporting further market diversification.

The market thus enters September cautiously, with the possibility of short-term rebounds as well as further corrections, while investors closely monitor developments in monetary policy and macroeconomic indicators.

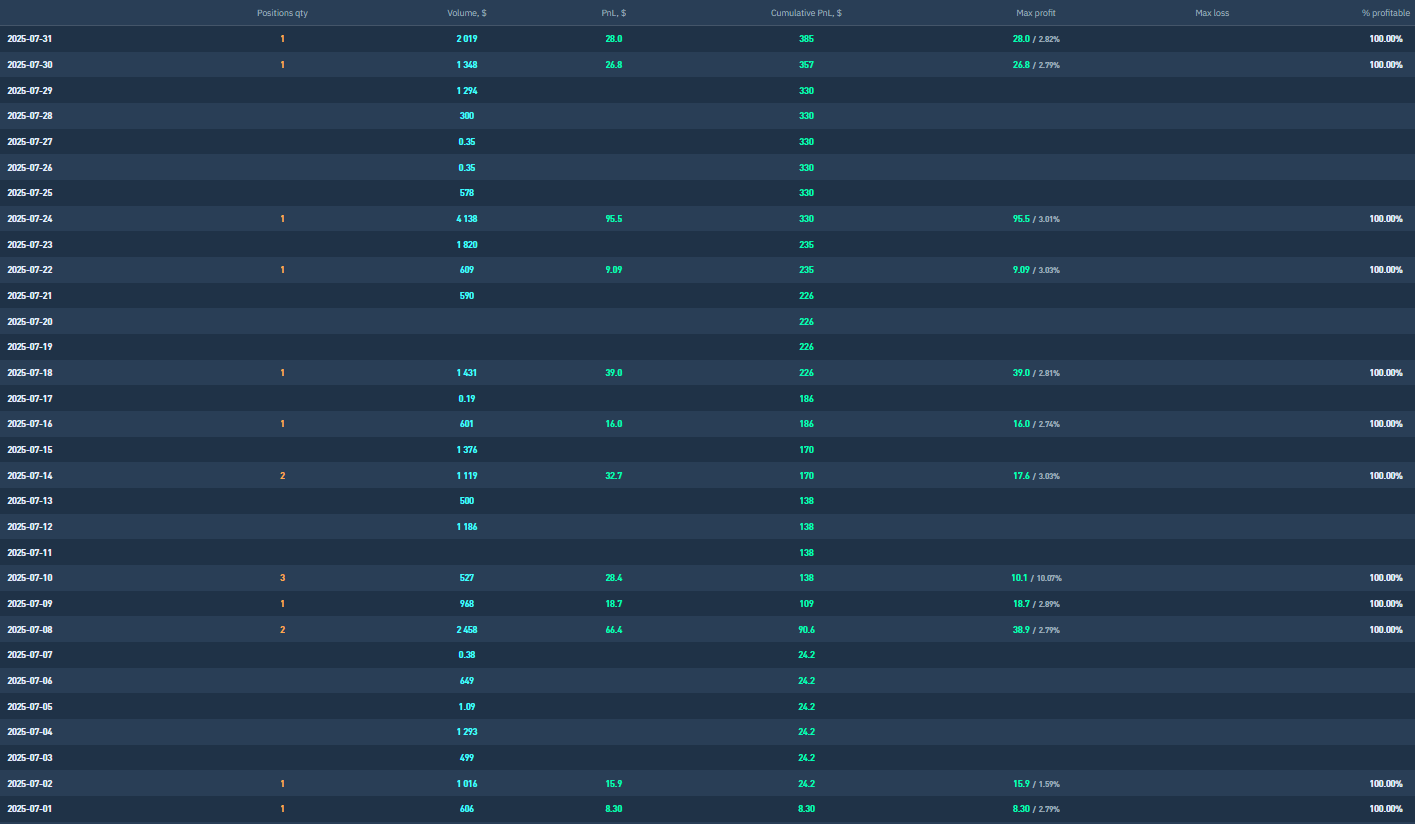

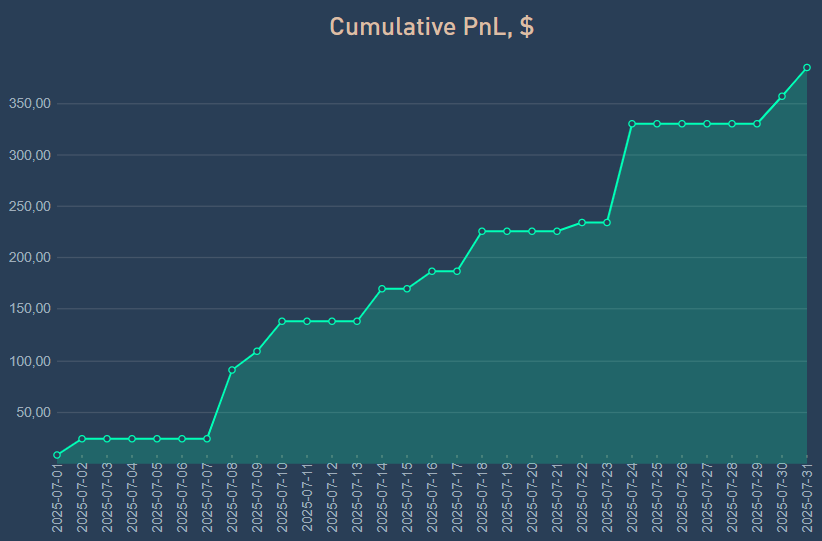

July 2025

+0,38%

Cryptocurrency Market in July 2025: Bitcoin in a Parabolic Phase, Dollar Falling, and Investors Losing Inhibitions

July 2025 will go down in history as the month when Bitcoin broke key milestones and entered its parabolic growth phase. While global geopolitical tensions subsided, markets – led by cryptocurrencies – accelerated to new records. The dollar lost value, while Bitcoin, gold, and silver reached all-time highs.

Geopolitics Calms, Markets Rise

The month began with a significant geopolitical sigh of relief. On July 1, 2025, the conflict between Israel and Iran suddenly came to an end, mediated by President Trump without deeper coordination with the parties involved. The ceasefire was accepted by both sides, albeit with some reservations.

Markets welcomed the move – investors appreciated the stability, and market volatility returned to normal levels. The most notable reactions were seen in oil, gold, and of course Bitcoin, which continued to hold its status as a safe haven.

Bitcoin Continues Uptrend

Since 2022, Bitcoin has strengthened by an incredible 592%, and July followed this trajectory. Five consecutive bullish half-year candles only confirmed the long-term upward trend.

As early as July 3, speculation arose as to whether Bitcoin was headed for $116,000 or a correction was coming. Short-term stagnation around July 6 was linked to uncertainty regarding US reciprocal tariffs, but investor sentiment remained optimistic.

US Dollar Weakens, Investors Seek Alternatives

On July 9, it was confirmed that the US dollar had lost more than 10% of its value since the start of the year, marking its worst year since 1973. This development significantly influenced global capital allocation.

On the same day, President Trump unveiled the legislative proposal “Big Beautiful Bill,” aimed at stimulating the US economy, but also further eroding confidence in the dollar. The result was growing interest in Bitcoin and precious metals, particularly as a hedge against inflation.

Bitcoin Breaks $120,000 and Pushes Higher

On July 11, Bitcoin reached $120,000, setting a new major milestone. Technical analysis indicated a strong upward trend, and the question became: is $150,000 realistic?

In the following days, the price continued to rise. On July 13, it closed the earlier gap at $114,000, and between July 17–20 it became clear that Bitcoin, gold, and silver were among the main winners in times of uncertainty.

On July 24, the market entered what is known as “rally mode,” and analysts speculated that the next stop could be $200,000.

Market Uncertainty and the Impact of Macro Events

Despite strong bullish sentiment, the market faced challenges. On July 25, Bitcoin options worth $12 billion expired, creating short-term price pressure. At the same time, investors awaited the outcome of Trump’s talks in Scotland (July 27), which had the potential to influence monetary policy and global markets.

While stock indices also hit record highs (July 28), the first signs of overvaluation appeared. On July 30, warnings were issued that stocks were “extremely expensive” and approaching a correction – traditionally a favorable setup for alternative assets like Bitcoin.

Bitcoin in Parabolic Phase: Targeting $150,000?

On July 31, Bitcoin entered what is referred to as the parabolic phase. The price began moving sharply upward, with investors talking about a $150,000 target before the end of summer. Both fundamentals and technicals remained strong, yet there was a growing belief that the market could soon overheat.

Summary and Outlook

July 2025 was one of the strongest months in Bitcoin and cryptocurrency history. Political stabilization, the dollar’s decline, and growing popularity of alternative investments created ideal conditions for massive growth.

Key events:

- End of the Middle East conflict calmed markets

- Bitcoin broke $120,000 and is heading higher

- Dollar experiencing its worst year on record

- Gold, silver, and Bitcoin as safe havens

- Speculation about cycle peak between $150,000–$200,000

What to watch next:

- US macroeconomic data and the Fed’s stance

- Trump’s economic policy and its impact

- Developments in stock markets and possible correction

- Further institutional inflows via ETFs

June 2025

+0,26%

Cryptocurrency Market in June 2025: Records, Geopolitics, and Tensions Ahead

June 2025 was an extremely dynamic month for cryptocurrency markets, demonstrating just how closely digital assets are tied not only to macroeconomic data but also to geopolitical developments. Bitcoin and Ethereum played dominant roles, with each asset experiencing its own price highs, corrections, and investment opportunities.

Record-Breaking Start: Bitcoin Hits All-Time High

The month began euphorically. On June 1, Bitcoin closed the highest monthly candle in its history, immediately triggering a massive price surge. Early in the week, BTC climbed above $110,000, and on June 3 – during the release of U.S. durable goods orders data – it reached as high as $110,745.

However, this rally was briefly interrupted by the first signs of a possible correction. On June 4, warning comments emerged about a potential return to $96,000, signaling that the market might be overbought.

Ethereum on the Rise, but with Caution

While Bitcoin was experiencing volatile swings, Ethereum (ETH) proved to be a steadily attractive alternative. Investor interest was supported primarily by growing volumes in spot Ethereum ETFs, in contrast to a decline in demand for Bitcoin funds.

This fueled bold speculation – could Ethereum hit $6,000 this year? That question was raised as early as June 3, and some analysts believed it could happen.

However, by June 14, concerns arose about a possible pullback to $2,100 – a move that could, in turn, present an ideal buying opportunity for long-term investors.

Geopolitical Shocks and Their Impact

The second half of June brought significant market turbulence due to rising tensions in the Middle East. On June 13, heightened risk of war was reported, having an immediate impact: the dollar weakened, while gold, silver, and to some extent Bitcoin strengthened.

The situation escalated on June 22, when the U.S. launched an attack on Iran. Although markets had expected a sharper sell-off, Bitcoin dropped only 2%, demonstrating its growing stability even in moments of crisis.

Bitcoin Correction and Stabilization

Market anxiety, combined with a June 19 warning from the U.S. Federal Reserve about overheated markets, led to a temporary drop in Bitcoin to $98,000 on June 23. This sparked speculation about the start of a bear market, but BTC soon rebounded to retest the $110,000 level on June 26.

Economic Factors: Dollar Under Pressure, Gold as a Safe Haven

Another significant driver was the weakening U.S. dollar. On June 27, another milestone was crossed – U.S. national debt rose above $37 trillion. Central banks began accelerating the shift of reserves from the dollar into gold.

The combination of growing U.S. debt and a falling currency boosted confidence in alternative assets, especially Bitcoin, which is increasingly seen by investors as “digital gold.” By June 30, analysts were already speculating that Bitcoin would continue rising through the end of the year, driven by the dollar’s decline.

Summer Outlook: Consolidation and Waiting

By the end of the month, the market began moving sideways, both for Bitcoin and Ethereum. It appeared that cryptocurrency markets were waiting for the next catalyst. On June 29, investors questioned what impact Donald Trump and his potential role in U.S. fiscal policy might have on the crypto market.

Summary and Outlook

June 2025 was a month of strong contrasts for the cryptocurrency market. On one hand, record gains and robust demand for Ethereum ETFs; on the other, geopolitical uncertainty and central bank warnings.

Key factors to watch:

- State of the global economy and U.S. monetary policy

- Developments in Middle East geopolitical tensions

- Institutional investor behavior toward spot ETFs

- Future direction of the U.S. dollar

Despite short-term volatility, both Bitcoin and Ethereum continue to prove themselves as resilient assets, weathering global uncertainty better than many traditional investments.

May 2025

+0,23%

April 2025

-9,46%

Cryptocurrency Market in April 2025: Bitcoin Defies Geopolitical Shocks and Aims for New Highs

April 2025 was a month of extreme volatility, uncertainty, and a return of investor

confidence in the cryptocurrency market, particularly for Bitcoin. While traditional stock

markets faced their steepest declines since 2022, Bitcoin, despite short-term sell-offs,

maintained relative stability and ended the month aiming once again at the $100,000

threshold.

Geopolitical Uncertainty and Market Panic

The month began in the red after President Donald Trump announced new reciprocal

tariffs, triggering widespread nervousness across global markets. From April 1 to 9, the

major U.S. stock indices Nasdaq and S&P 500 plunged by 20% and 15% respectively,

marking their worst drop since 2022. Uncertainty was further fueled by disappointing

inflation data (PCE), which exceeded negative expectations and reinforced fears that the

Federal Reserve would need to maintain a restrictive monetary policy longer than

anticipated.

Bitcoin initially responded resiliently, holding above $82,000, but as panic continued to

ripple through markets, its price gradually declined, falling below $75,000 by April 7.

Nevertheless, it was still perceived by many investors as a relatively stable asset in

turbulent times.

Stabilization and Return of Optimism

After the initial chaos, the situation began to stabilize. From April 13 onward, the first

signs of recovery emerged. Bitcoin fluctuated in the $80,000–$87,000 range, as investors

speculated whether it was ready for another upward move. This anticipation began to

materialize during the week of April 20, when Bitcoin broke through $87,000 and reached

$94,000 by April 24.

In contrast to the stock market, where a “death cross” emerged on April 18 (a technical

signal of potential recession), the cryptocurrency showed bullish momentum. This was

further reinforced when Bitcoin approached the psychological $100,000 level on April 25.

Although the price briefly pulled back below $90,000 by month’s end, the market

demonstrated strong technical fundamentals and readiness for further growth.

Conclusion: Bitcoin as a Safe Haven?

April highlighted Bitcoin’s ability to retain investor trust amid geopolitical uncertainty

and rising inflationary pressures. Despite volatility and strong early-month corrections,

the cryptocurrency not only stabilized but posted significant gains while traditional

markets struggled.

Although overall sentiment remains fragile and future developments will be heavily

influenced by political decisions and macroeconomic data, the cryptocurrency market in

April 2025 showcased its growing maturity and strengthening role in investors’

portfolios.

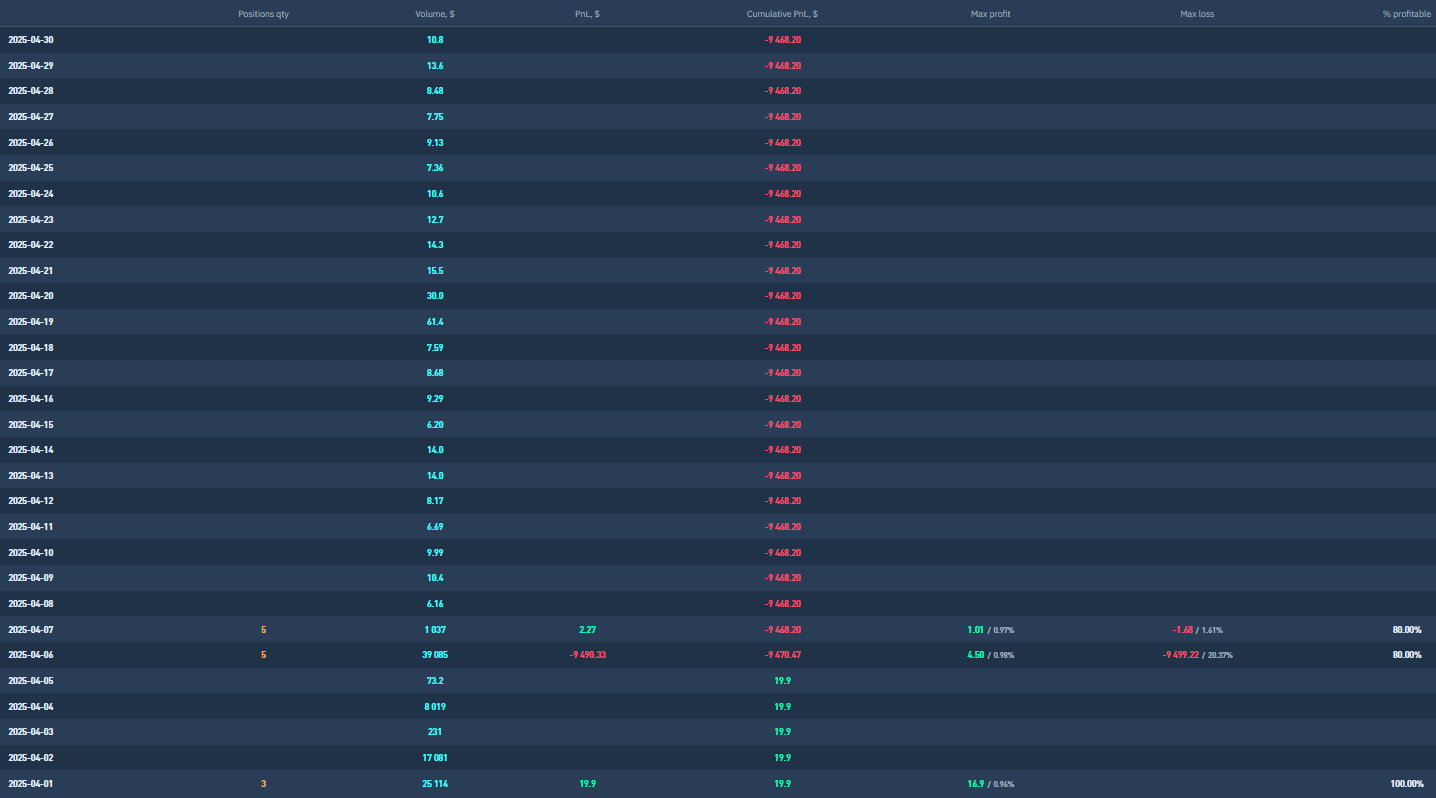

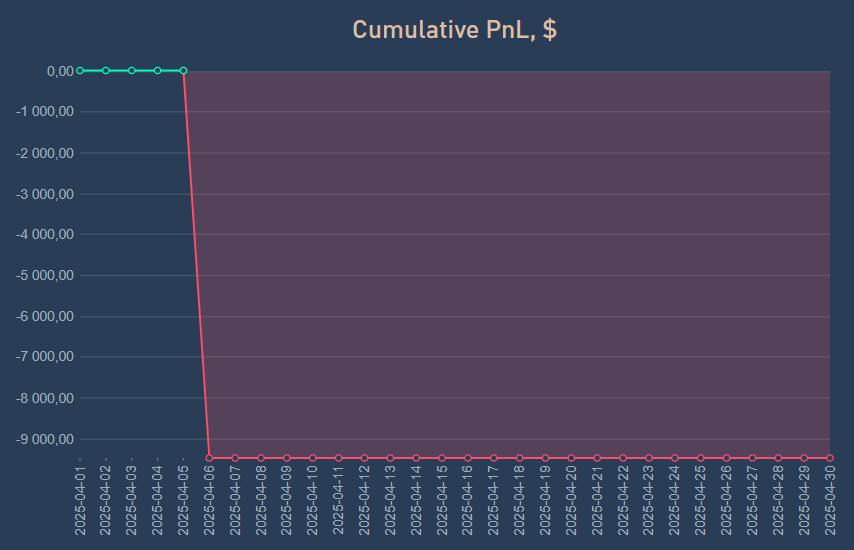

Final Note from the Algomoneo Team

April 2025, like for many other market participants, was not an ideal period from an

investment standpoint. It was the result of a combination of factors, the most impactful of

which was the sudden removal of a large number of trading pairs on Binance in response

to the new European MiCA regulation. This disruption in market infrastructure naturally

affected the performance of our algorithm, which operates primarily on this platform.

From our years of experience, we know that such events are inevitable from time to time

in dynamic markets. That’s why it’s essential to maintain strategic perspective, learn

from setbacks, and focus on maximizing efficiency during more favorable conditions. We

view April’s outcome not as a reason to panic, but as a valuable experience and an

opportunity for improvement.

We would also like to highlight that all withdrawals of profits and principal were

processed smoothly throughout the month—and continue to be. The Algomoneo project

moves forward with full commitment and confidence in positive developments. We

believe April 2025 will prove to be just a brief episode in an otherwise fascinating and

long-term growth environment for the cryptocurrency market.

Based on our current analysis, we also expect May to bring a strong rebound and a

continuation of the bull trend. According to our forecasts, Bitcoin has the potential to

surpass the $104,000 level.

Warm regards,

The Algomoneo Team

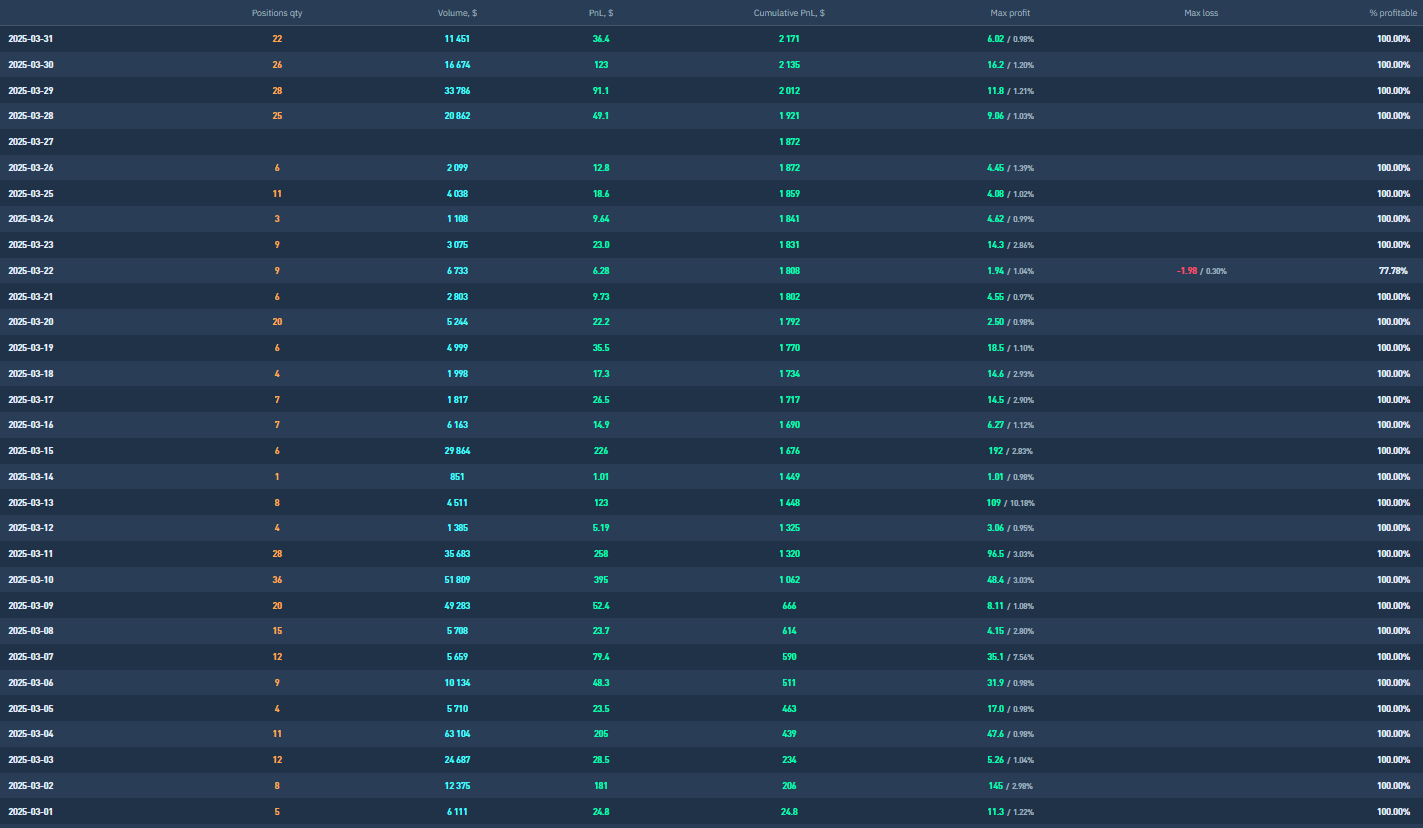

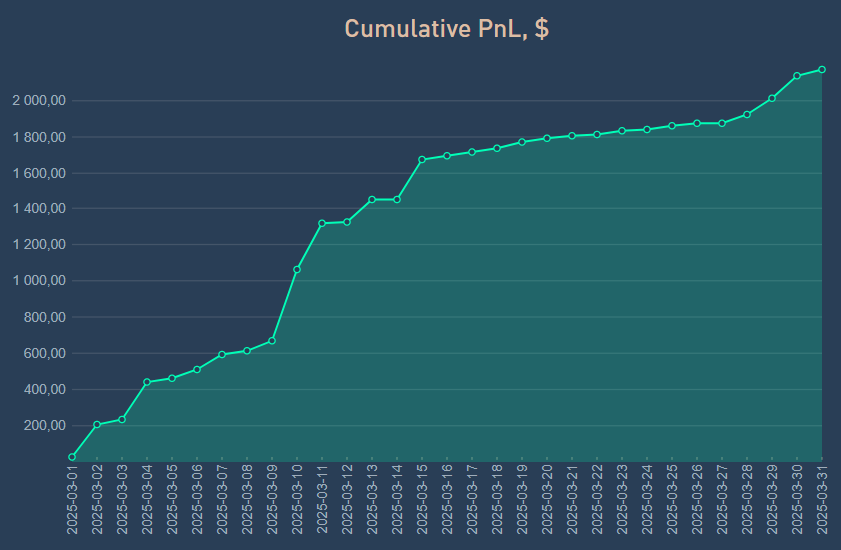

March 2025

+2,17%

Evaluation of the Cryptocurrency Market Development in March 2025

March 2025 brought exceptionally dynamic developments in the cryptocurrency markets, significantly influenced by macroeconomic factors and political events in the United States. The month began with a strong surge in Bitcoin’s price. On March 1, following a brief correction to $78,300, Bitcoin rebounded and climbed back to $86,000—representing an almost 10% increase within a single day. The market reacted to U.S. macroeconomic data, specifically the core PCE index, which slowed year-over-year to 2.6%, increasing expectations for interest rate cuts. This development supported positive market sentiment and contributed to Bitcoin’s price growth.

In the following days, the market experienced increased volatility driven by emotions and geopolitical concerns. On March 2, reports surfaced about the risk of Bitcoin dropping below $83,000 amid rising tensions over U.S. trade policy and fears of a recession. Solana also lost momentum, with its total value locked (TVL) dropping by 40%. A significant market catalyst came from U.S. President Donald Trump, who announced the creation of a strategic cryptocurrency reserve for the United States, including Bitcoin, Ethereum, XRP, Solana, and Cardano.

From March 3 to 5, the cryptocurrency market continued its upward trajectory. Hedge funds and venture capital firms increased their activity, pushing Bitcoin’s price above $95,000. XRP temporarily surpassed Ethereum in fully diluted market capitalization. Trump’s announcement of a digital reserve fueled market optimism, although it later became evident that investor expectations were overly optimistic.

In the days that followed, the market began to stabilize. From March 6, Bitcoin consolidated around $87,000. On March 7, Trump signed an executive order officially establishing the strategic Bitcoin reserve, pushing the price to $94,000. However, volatility quickly returned, and on March 8, Bitcoin dropped to $84,000. That same day, BCA declared the U.S. economy officially on the brink of recession.

Between March 9 and 12, Bitcoin’s price fluctuated between $82,000 and $90,000. Investor sentiment was negative, reaching its lowest point in three years. U.S. trade policy and macroeconomic uncertainty weighed heavily on the markets. Ethereum came under pressure due to weak on-chain activity and outflows from spot ETFs.

In the second half of the month, the market’s choppy trend persisted. After briefly reaching $90,000 on March 16, Bitcoin declined again due to growing geopolitical tensions, especially concerning U.S. tariffs and the potential for retaliatory measures by the EU. On March 18, predictions surfaced of Bitcoin reaching $126,000, though market conditions remained unstable. Recession fears in the U.S. intensified, as echoed by J.P. Morgan’s chief economist on March 19.

From March 20 to 24, analysts described the current development as a normal correction. The Fed kept interest rates unchanged and signaled a more dovish monetary stance. This helped Bitcoin reach a two-week high above $88,000. At the same time, institutional capital inflows increased. Despite a weakening U.S. dollar, Bitcoin stagnated on March 25, failing to capitalize on favorable macro conditions.

The final days of the month brought mixed signals. On March 28, Trump announced 25% tariffs on foreign-made vehicles, reigniting concerns of escalating trade wars. XRP faced a potential 50% correction, and Bitcoin approached the $78,000 mark. On March 31, the market closed with a slightly optimistic tone—analysts speculated about a possible return to an uptrend but also warned of persisting risks, including the PCE report and new trade tariffs.

Overall, March 2025 was marked by high volatility in the cryptocurrency market, driven by a combination of economic data, political decisions, and speculative investor reactions. Bitcoin traded in a range between $78,000 and $95,000, ending the month around $84,000–$88,000. Ethereum and other altcoins experienced similar turbulence, with XRP temporarily overtaking Ethereum and Solana suffering a significant decline.

February 2025

+0,56%

Evaluation of Events in the Cryptocurrency World – February 2025

February 2025 was an exceptionally dynamic period for the cryptocurrency market, filled with significant events that influenced the price of Bitcoin and other digital assets. The impact of geopolitics, macroeconomic factors, and investor behavior created substantial volatility and uncertainty in the market. Let’s take a look at the key moments of the month.

Early February: Initial Market Shocks

At the very beginning of the month, the market was hit by Trump’s policy of imposing tariffs on China, Canada, and Mexico. This move contributed to a significant decline in U.S. tech stocks, which had a direct impact on Bitcoin, pulling it back to the $100,000 level. Investors’ expectations were focused on the Federal Reserve meeting, which left interest rates unchanged. However, this did not prevent further fluctuations.

Tech Stock and Bitcoin Crash

On February 3, the market experienced one of its steepest declines, with Nvidia shares losing over 18% of their value, representing a market capitalization loss of over $600 billion. This shock immediately affected Bitcoin’s price, which plunged below $92,000. Due to the strong correlation between tech stocks and cryptocurrencies, concerns about a potential long-term bear market started to emerge.

Massive Liquidation of Positions in the Market

During the first week of February, the cryptocurrency market experienced its largest liquidation of trading positions in recent months. The price drop triggered a cascading effect of forced liquidations, with the total value of liquidated positions reaching between $8 and $10 billion. Ethereum suffered a particularly severe decline, dropping 35% in two days to $2,133. Other altcoins, such as Avalanche, XRP, Chainlink, and Dogecoin, also saw significant losses of up to 20% of their value.

Market Uncertainty and Bitcoin Stagnation

At the beginning of the second week of February, it became clear that Bitcoin was unable to maintain a value above $100,000 for an extended period. The growth momentum of cryptocurrencies was weakened by high inflation and the Federal Reserve’s reluctance to lower interest rates. Altcoins also experienced a tough period, with Ethereum plunging 26% in a single day.

Surprisingly, Eric Trump entered the cryptocurrency discussion, calling Ethereum a lucrative investment. His statement led to an immediate price surge in ETH and further market speculation.

Major Events in the Second Half of February

The cryptocurrency market continued to be plagued by uncertainty. By mid-month, Bitcoin attempted to stabilize above $98,000, but continued pressure from investors led to further declines. Outflows from Bitcoin ETFs reached $651 million, raising concerns about future price movements.

On February 21, a negative signal appeared in the market in the form of a series of “death crosses,” indicating a possible drop in Bitcoin to $92,000. Additionally, reports surfaced about a hack on the Bybit exchange, where over $1.4 billion in ETH tokens were stolen, further contributing to investor anxiety.

End of the Month: Bitcoin in Crisis

In the final week of February, the market situation worsened. Macroeconomic uncertainty, inflationary pressures, and ongoing trade tensions between the U.S. and China led to Bitcoin falling below $87,000. Technical indicators signaled the beginning of a bear market, with Bitcoin’s price dropping over 20% from its all-time high.

On February 28, BTC’s price fell below $80,000, erasing all gains made after Trump’s re-election. This decline was accompanied by panic in the market, which led to a surge in some altcoins, particularly XRP, which maintained strong momentum.

Conclusion

Given the massive losses recorded by many traders across the market and the fact that these losses had fatal consequences for some, Algomoneo managed to navigate through this unprecedented crisis with confidence and ended the month with a 0.56% gain. While this result is not particularly impressive, it speaks to the uniqueness and exceptional nature of our system. It proves that even when the market experiences historically significant fluctuations, Algomoneo can still generate profits.

Thank you for your support and trust.

With respect,

Your Algomoneo Team

January 2025

+1,71%

Development of Cryptocurrencies in January 2025: Volatility, Records, and Political Influence

January 2025 was a period of extreme volatility, historic milestones, and significant political events for the cryptocurrency market. The price movements of Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies were influenced by macroeconomic factors as well as political changes in the U.S., where Donald Trump returned to office.

Early January: Market Optimism and Record Stablecoin Reserves

Right from the start of the year, it was evident that the crypto market was entering a new phase of optimism. On January 1, analysts speculated that Bitcoin could rise to $110,000, supported by record stablecoin reserves that provided sufficient liquidity to drive prices higher. However, by January 5, signals of a possible correction to $90,000 had emerged.

Bitcoin Surpasses $100,000, But Faces a Correction

On January 6, Bitcoin once again surpassed the $100,000 mark, but the market required higher trading volumes to reach $105,000. At the same time, Solana experienced a massive influx of $1 billion in stablecoins, indicating growing investor interest in its ecosystem.

Two days later, on January 8, Bitcoin’s price dropped in response to an increase in U.S. job openings, which strengthened the U.S. dollar and weakened BTC. Meanwhile, Ethereum showed strong growth signs, with predictions suggesting it could reach $8,000.

Market Panic Strikes, Bitcoin Falls to $92,000

On January 10, Bitcoin fell to $92,000, sparking mild panic among investors as another attempt to break above $100,000 failed. Speculation about a potential sale of seized Silk Road Bitcoins drove prices down, impacting spot Bitcoin ETFs as well. Three days later, on January 12, predictions surfaced that Bitcoin was heading toward $80,000, as rising U.S. bond yields and a strong dollar altered market expectations.

Political Uncertainty and Its Impact on Cryptocurrencies

On January 15, the situation became even more complicated with reports that the U.S. planned to sell $6.5 billion worth of Bitcoin. This move could have triggered a BTC price collapse, reinforcing theories of a post-halving Bitcoin decline in January. Market uncertainty grew a week before Donald Trump’s inauguration.

Trump’s Inauguration and Its Influence on the Crypto Sector

On January 20, attention turned to Donald Trump’s inauguration, which had the potential to either push Bitcoin higher or drop it back below $100,000. Trump’s own TRUMP coin became a sensation, while MicroStrategy took advantage of Bitcoin’s price dip to make additional purchases, surpassing 450,000 BTC in its holdings.

The next day, Trump signed an executive order to establish a national cryptocurrency reserve while simultaneously banning central bank digital currencies (CBDCs). This move was seen as a signal of growing cryptocurrency adoption in the U.S.

End of the Month: Stabilization and New Records

By the end of January, Bitcoin was recovering and resuming its growth. After dropping to $92,000 on January 28, it climbed back above $105,000 on January 30 as the market reacted to the Federal Reserve’s decision to keep interest rates unchanged.

XRP and Solana continued to attract traders’ attention due to increasing support from the Trump administration, while Ethereum was preparing for potential historic growth in February and March.

Summary

January 2025 demonstrated how political and macroeconomic factors heavily influence the cryptocurrency market. Donald Trump’s return to the White House triggered multiple market movements, whether through his crypto-related executive orders or speculation about possible tax incentives for digital asset holders.

Despite Bitcoin facing several drops, its ability to recover above $100,000 showcased growing investor confidence. Ethereum, Solana, and XRP also experienced key moments that could shape their future in 2025. The coming months will determine whether the market can sustain its growth trend or face another correction.

Regardless, 2025 is shaping up to be a pivotal year for cryptocurrency development.

Conservative Algomoneo Settings for January 2025

Given the extreme volatility and unpredictable macroeconomic factors, the Algomoneo trading algorithm was adjusted for maximum caution. The strategy focused on capital protection and risk minimization, reducing exposure during sharp price swings. In January, the Algomoneo algorithm favored shorter trading horizons with an emphasis on stable entry and exit points, avoiding unexpected market downturns. At the same time, stricter stop-loss mechanisms were implemented, and the frequency of high-leverage trades was reduced. This conservative approach proved crucial in navigating the challenging January conditions and provided a stable foundation for future strategies in the coming months.

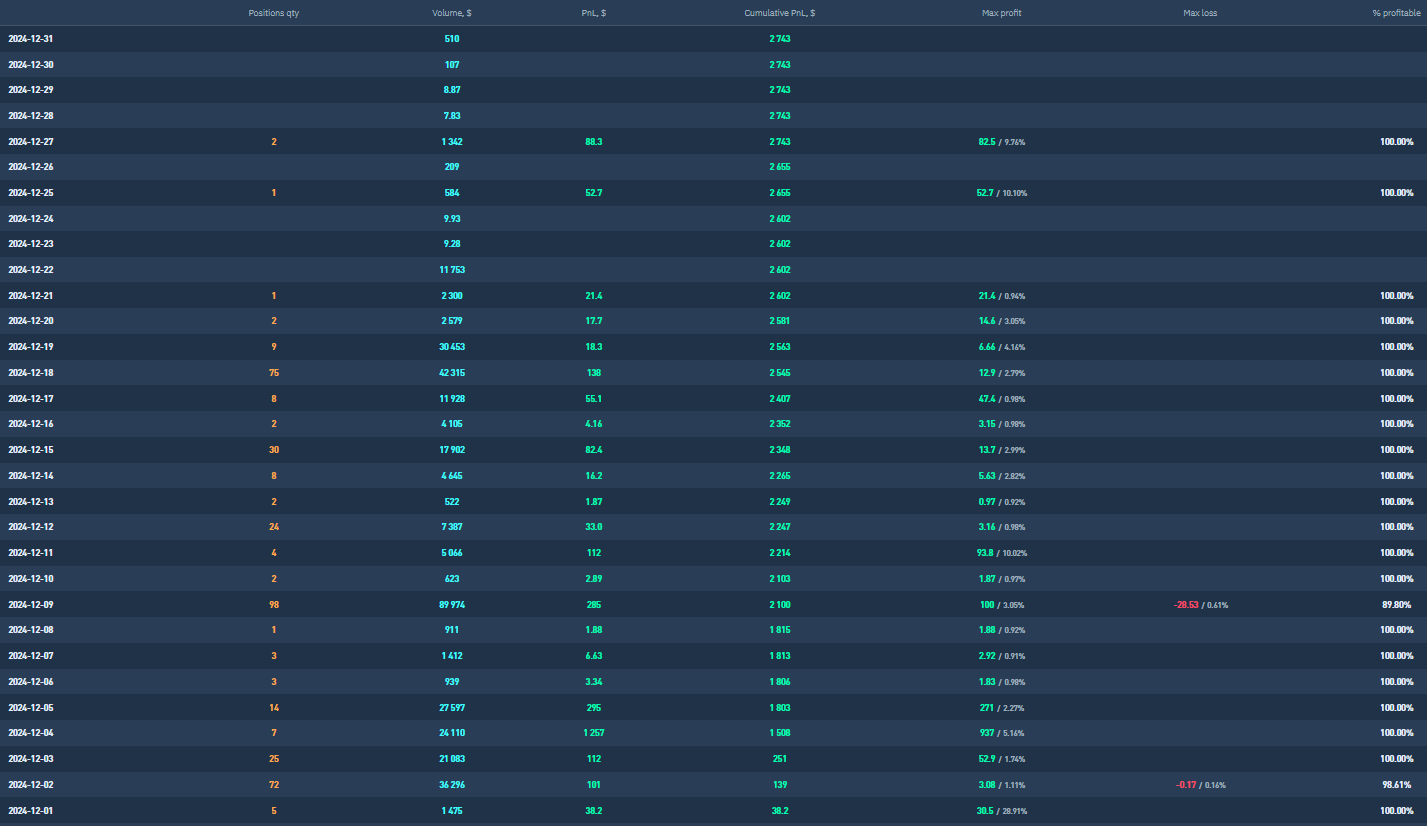

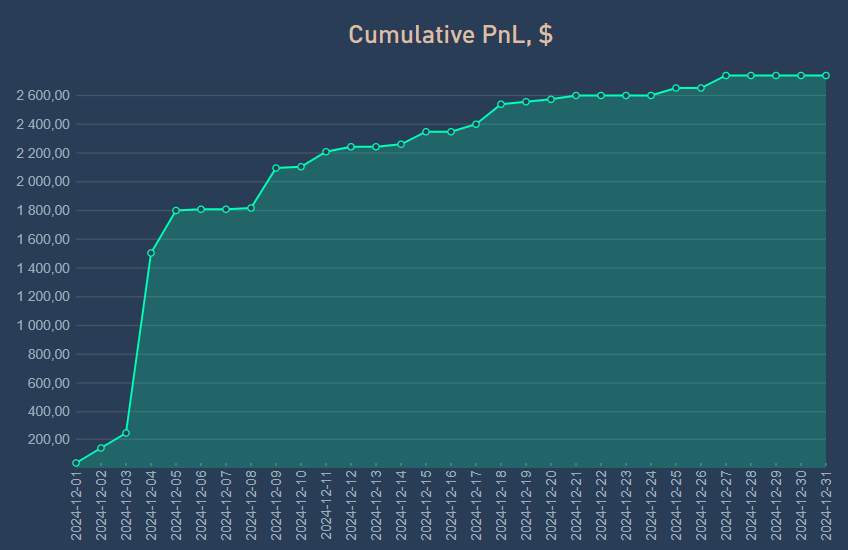

December 2024

+2,74%

Cryptocurrency Developments in December 2024: Bitcoin, Inflation, and Market Turbulence

December 2024 brought significant volatility to cryptocurrency markets, during which Bitcoin and altcoins faced dramatic price swings. Throughout the month, growth impulses alternated with sharp corrections, with the overall cryptocurrency market heavily influenced by macroeconomic factors, especially inflation indicators, decisions by the U.S. Federal Reserve, and speculative investor behavior.

Beginning of the Month: Bitcoin Battles the $100,000 Threshold

December started optimistically as Bitcoin ended November with a nearly 40% gain, fueled by the expiration of Bitcoin options. However, on December 2, Bitcoin faced resistance just below the psychological level of $100,000. This development reflected investor uncertainty following the release of U.S. Personal Consumption Expenditure (PCE) inflation data, which aligned with expectations. Inflation remains one of the key factors shaping market expectations.

First Half of December: Altcoins on the Rise, Bitcoin in Volatility’s Grip

During the first half of the month, Bitcoin repeatedly struggled with selling pressure in the $98,000–$99,000 range. This development was accompanied by a decline in Bitcoin’s dominance, allowing some altcoins to rise. For instance, on December 4, Bitcoin fell to $94,000 but quickly recovered to levels near $98,000 due to optimistic news about a potential replacement of the SEC chairman with a crypto-friendly figure. This speculative impulse pushed Bitcoin’s price to $104,000 on December 5, surpassing the $2 trillion market capitalization threshold.

However, the following days brought a correction. Federal Reserve Chairman Jerome Powell compared Bitcoin to gold, which markets interpreted as a bullish signal. But after a sharp rise to nearly $99,000, massive profit-taking drove the price back to around $91,000. This correction was short-lived, and Bitcoin quickly returned to the $100,000 threshold.

Second Half of the Month: Economic Uncertainty Hits Markets

Macroeconomic factors continued to heavily influence the cryptocurrency market. The U.S. economy showed signs of slowing, underscored by rising unemployment and falling commodity prices such as oil and copper. Despite this, MicroStrategy announced the purchase of over 12,000 Bitcoins at an average price of $98,500, providing the market with some support.

A significant turning point occurred on December 19 when the Fed, at its final meeting of the year, presented a hawkish economic projection for 2025. Markets reacted strongly negatively—both stocks and cryptocurrencies suffered significant losses, with Bitcoin dropping 6% to $95,500. This decline was driven by expectations of slower interest rate cuts than the market had anticipated.

End of the Month: Bitcoin Under Pressure, Hopes for a Rebound

Bitcoin ended 2024 below the $100,000 mark, reaching $95,925 at the start of the last week of December. Whales began signaling a return to buying, offering the market hope for growth. However, Friday’s stock market slump and poor performance from the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) dragged Bitcoin’s price down to $93,000 on December 29.

Despite these fluctuations, Bitcoin remains in a long-term bullish trend. Markets are now focusing on the support range between $90,000 and $92,000, which could prevent further significant declines. If this support fails, a drop to around $85,300, where the 100-day exponential moving average (100DEMA) lies, may follow.

Final Assessment

December 2024 was a month filled with tension and dramatic twists for cryptocurrency markets. Bitcoin repeatedly attempted to surpass the $100,000 threshold but faced strong selling pressure and macroeconomic uncertainty. Nonetheless, it remains the primary driver of the cryptocurrency market, with its volatility and responses to global economic events affirming its growing importance in the financial world.

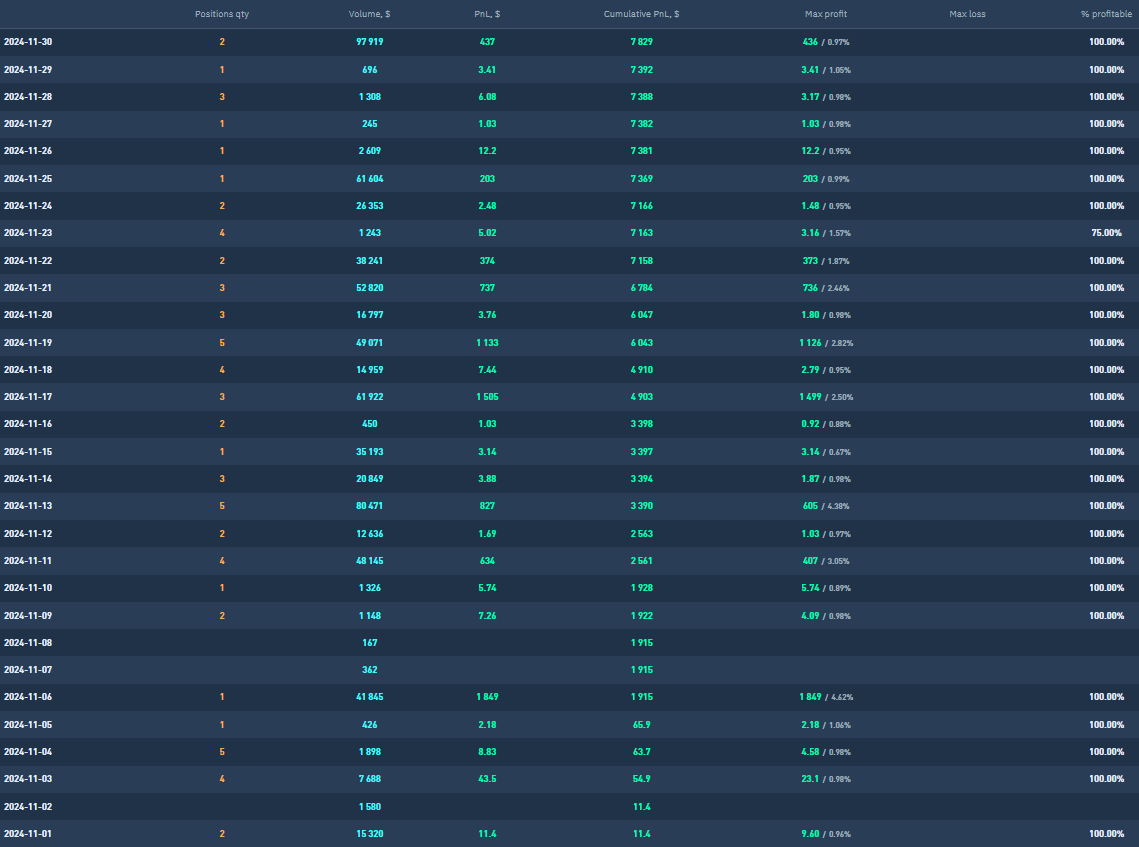

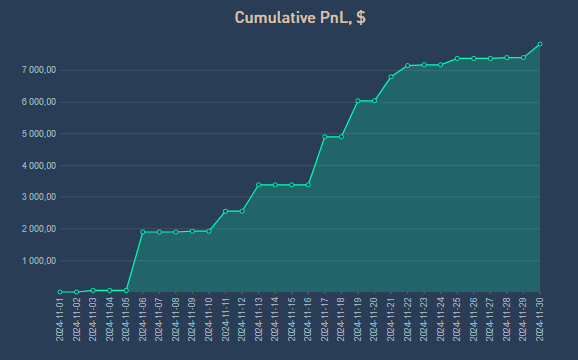

November 2024

+7,8%

Cryptocurrency Development in November 2024: Record Growth, High Volatility, and the Role of Algomoneo

November 2024 was a period of unprecedented growth for the cryptocurrency market, driven by strong political factors, a record influx of capital, and high market volatility. This volatility became the ideal environment for utilizing the advanced trading algorithm Algomoneo, which, thanks to its ability to analyze and respond to market movements in real-time, was able to leverage the potential of these rapid changes to maximize profits.

Investment Records, Political Influences, and Volatility

The growth of cryptocurrency assets in November was not coincidental. Capital inflows into digital asset investment products reached an astonishing $27 billion in 2024, nearly three times the record set in 2021, when investments amounted to $10.5 billion. This massive expansion was partly driven by positive political signals from the U.S., where increasing support for the Republican Party, particularly in the lead-up to the presidential elections, led to an optimistic outlook for cryptocurrencies.

High volatility, which dominated the cryptocurrency markets in November, became an ideal opportunity for algorithmic trading systems like Algomoneo. This algorithm was designed to identify rapid market movements and react instantly, allowing it to optimally capitalize on sharp price changes and maximize profits. Algomoneo, which focuses on analyzing historical trends, market sentiment, and many other technical indicators, was able to predict short-term price movements with high accuracy and use them to execute trades at the ideal time.

Bitcoin and Ethereum: Growth and Volatility as Opportunities

Bitcoin, which had already broken its records multiple times in the past, saw another historic rise in November 2024. After an incredible jump from $75,000 at the start of the month, the price of Bitcoin surged to a new high on November 10, surpassing $79,000. This trend continued, and on November 12, Bitcoin broke the $89,000 mark, with its market capitalization surpassing $1.7 trillion for the first time in its history.

During this period of volatility, when the price of Bitcoin fluctuated by more than $10,000 within a few days, Algomoneo proved to be a tool that could effectively capitalize on this volatility. The Algomoneo algorithm responded to each price fluctuation, allowing it to take advantage of unexpected market direction changes.

Ethereum, the second-largest cryptocurrency by market capitalization, also reached a significant milestone, with the price rising to $3,200 on November 10. This growth was mainly driven by the increasing demand for Ethereum ETFs, which saw record capital inflows, as well as a positive mood in the cryptocurrency markets. Algomoneo took advantage of these trends by accurately predicting the optimal buy and sell moments based on Ethereum’s price behavior, achieving significant profits.

Market Correction and Outlook for Further Growth

Despite the strong growth and the breaking of several historic records, Bitcoin experienced some correction toward the end of the month on November 27. The price of Bitcoin hovered around $92,500, which was lower than its recent highs but still represented solid growth compared to the start of the month. In this dynamic environment, Algomoneo again proved to be an invaluable tool, analyzing market movements and quickly adjusting its strategies.

Traders and analysts focused on technical signals that indicated potential strong price movements. The high volatility that is likely to continue affecting the cryptocurrency market will remain fertile ground for the Algomoneo algorithm, which will continue to benefit from these price fluctuations.

The Role of Cryptocurrencies in Politics

A significant factor influencing the development of cryptocurrencies in November was direct support from the new U.S. administration under President Donald Trump. Following his victory in the presidential elections, the cryptocurrency market, particularly Bitcoin, received substantial political support. The Trump administration promised specific steps to support digital assets and create an environment favorable to miners and investors, which had a positive impact on the markets.

Conclusion

November 2024 was a historic month for the cryptocurrency sector, where strong market trends collided with political changes and high market volatility. With December approaching, it is expected that cryptocurrencies, especially Bitcoin and Ethereum, will continue to experience high volatility, with the political situation in the United States remaining a key factor. Investors and traders remain optimistic about the future, not only in terms of price development but also regarding regulations and legislative changes that could simplify access to digital assets.

October 2024

+1,65%

Historical Trends and the Future of Cryptocurrencies in the Fourth Quarter of 2024

In October 2024, signs began to emerge in the cryptocurrency market suggesting that Bitcoin and other digital currencies could experience significant growth, similar to past instances. Experts pointed out that the upcoming elections in the United States and the recent halving could have a substantial impact on the price of Bitcoin. Historically, halving has led to an increase in value, supported by data from analytical platforms showing that in the past, Bitcoin’s price increased by more than 50% in the fourth quarter up to six times, with some years seeing a rise of as much as 168%.

Cryptocurrency experts emphasized the lack of solutions to the problems of rising national debt from major political forces, creating favorable conditions for Bitcoin as an alternative safe haven during times of economic uncertainty. While the market attracted attention with its price movements, experts warned that a price increase is not always the most important aspect; rather, the growing interest of individual investors in cryptocurrencies is key.

Another factor that could influence the future of cryptocurrencies was the monetary policy of the central bank. Lowering interest rates could have a positive impact on the value of Bitcoin if it is possible to stabilize the economy without a recession. Experts expressed optimism that Bitcoin could perform similarly to traditional financial markets, which would strengthen its position in the global market.

In the previous third quarter, the cryptocurrency market faced a bearish trend, consistent with historical patterns. The index reflecting market sentiment fell to a level indicating prevailing concerns.

As the U.S. elections approached, the cryptocurrency market began to show signs of stabilization. Historical data suggested that the fourth quarter is typically a strong period for Bitcoin, which has averaged a price increase of over 90% in the last decade.

Despite experiencing volatility, Bitcoin surpassed the price of $66,000 in mid-October 2024, signaling growing investor confidence. Cryptocurrency-focused investment funds saw a record influx of capital, with Bitcoin ETFs alone attracting hundreds of millions of dollars in a single day. Ethereum also exhibited positive trends, with its price stabilizing around $2,600.

By the end of October, Bitcoin exceeded $69,000, sparking optimism in the market. This upward trend was also evident in alternative cryptocurrencies such as Solana and Dogecoin, indicating that investors were beginning to trust the entire cryptocurrency market once again. Experts considered that Bitcoin might be exerting pressure on government budgets by presenting an alternative to traditional investments like government bonds.

Analysts agreed that upcoming events, including the regulation of stablecoins and acquisitions of payment platforms, could have far-reaching implications for the cryptocurrency ecosystem. Data from analytical tools also indicated an increase in wallets focused on accumulating Ethereum, reflecting a growing interest in long-term investments.

As the cryptocurrency market entered the end of 2024, questions arose regarding its future. Based on historical data and current trends, it appeared that the fourth quarter could be a period of strong growth and greater stability, potentially presenting opportunities for investors in the digital asset space.

September 2024

+1,4%

At the beginning of the month, Bitcoin reacted to the announcement of a decrease in interest rates by the Federal Reserve, which led to a slight increase in its value. However, the current ratio of Bitcoin’s price to the S&P 500 index suggested a potential decline.

The following days showed that Bitcoin still could not break through the stubborn resistance level of $70,000. Market speculation, however, indicated that the cryptocurrency might maintain its bullish momentum and even seemed poised to reach a new all-time high in the near future. After an initial sell-off, Bitcoin attempted to surpass the $60,000 level again, which sparked interest among investors.

While central banks invested in gold in record volumes, Bitcoin remained an increasingly attractive alternative. The largest “cup and handle” pattern was forming on the Bitcoin chart, which drew significant attention and triggered speculation about a possible massive reversal.

Historical analyses suggested that Bitcoin could experience a significant breakout by the end of the month, and investors were preparing for a potential price boom. Additionally, Dogecoin showed signs of doubling its value, which could ignite a new season of meme coins.

As days went by, the latest data from the U.S. labor market stirred the market. Bitcoin tested levels around $54,000 for the second time, while Ethereum dropped to a monthly low. Analysts speculated whether the worst was already behind us or if we were in for an even deeper decline.

Gradually, Bitcoin showed signs of recovery, and analysts began pointing out the first higher low, signaling possible stabilization. When Bitcoin surpassed $60,000 again, the market began to wonder if we had entered a full bull market.

The following days brought news of the expected reduction in interest rates by the Fed, leading to further speculation about Bitcoin’s reactions. After the rate cut, Bitcoin reached $62,600, although warnings of a potential decline in U.S. stocks began to emerge.

In the days that followed, Bitcoin approached $64,000, with key price levels becoming crucial for further development. There was euphoria in the stock market, and many investors considered the Fed’s decision to be correct. While the Ethereum ETF showed a positive turnaround, overall outflows from the market continued.

By the end of the month, Bitcoin found itself on the brink of growth, as historical cycles indicated an impending price increase. The weekly RSI suggested that Bitcoin could soon soar to $85,000. Following the rate cut, there was an influx of capital into Bitcoin amounting to $321 million.

Bitcoin also focused on the target price of $78,000, aided by a Chinese stimulus package that raised market expectations. Additionally, news of the release of the Binance founder from prison added to the momentum of discussions about the future direction of the market.

In the closing days of the month, Bitcoin indicated that it was preparing for a great end to the year, although estimates suggested that it would likely not reach the $70,000 level as quickly as originally expected.

For the Algomoneo algorithm, however, September was not an exceptional month, either positively or negatively. With standard performance, the algorithm achieved a result of +1.4%, indicating a not very high rate of opportunities. This aligns with the fact that historically, September has not been the most favorable month for cryptocurrencies.

Introduction and General Market Overview